|

DSP Small Cap Fund Small Cap Fund- An open ended equity scheme predominantly investing in small cap stocks |

|

|

Vinit Sambre

Total work experience of 21 years.

Managing this Scheme since June 2010

Resham Jain

Total work experience of 12 years.

Managing this Scheme since March 2018

Jay Kothari (Dedicated Fund Manager for

overseas investments)

Total work experience of 16 years.

Managing this Scheme since March 2013.

Jun 14, 2007

S&P BSE SmallCap (TRI)

| Regular Plan | |

| Growth: | ₹ 60.034 |

| Direct Plan | |

| Growth: | ₹ 63.216 |

₹ 5,320 Cr

₹ 5,251 Cr

0.17

| Standard Deviation : | 28.35% |

| Beta : | 0.96 |

| R-Squared : | 97.28% |

| Sharpe Ratio : | -0.13 |

| Regular Plan : | 2.00% |

| Direct Plan : | 1.16% |

Small cap

13 Yr 3 Mn

Holding period <12 months: 1%

Holding period >=12 months: Nil

Data As On September 30, 2020

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Industrial Products | 11.81 |

| ✔ Nilkamal Limited | 2.84 |

| Finolex Industries Limited | 1.99 |

| Swaraj Engines Limited | 1.97 |

| Finolex Cables Limited | 1.82 |

| SRF Limited | 1.71 |

| Mold-Tek Packaging Limited | 0.97 |

| Srikalahasthi Pipes Limited | 0.34 |

| IFGL Refractories Limited | 0.18 |

| Pharmaceuticals | 9.98 |

| ✔ IPCA Laboratories Limited | 6.24 |

| JB Chemicals & Pharmaceuticals Limited | 2.19 |

| Aarti Drugs Limited | 1.55 |

| Auto Ancillaries | 8.52 |

| ✔ Tube Investments of India Limited | 2.91 |

| ✔ Suprajit Engineering Limited | 2.52 |

| Subros Limited | 1.15 |

| Varroc Engineering Limited | 0.94 |

| Lumax Auto Technologies Limited | 0.51 |

| Sandhar Technologies Limited | 0.49 |

| Ferrous Metals | 8.18 |

| ✔ APL Apollo Tubes Limited | 3.31 |

| ✔ Ratnamani Metals & Tubes Limited | 2.86 |

| Kalyani Steels Limited | 0.97 |

| Kirloskar Ferrous Industries Ltd. | 0.78 |

| Vardhman Special Steels Limited | 0.27 |

| Chemicals | 8.01 |

| ✔ Atul Limited | 4.98 |

| GHCL Limited | 1.43 |

| Navin Fluorine International Limited | 1.41 |

| Plastiblends India Limited | 0.19 |

| Consumer Durables | 7.58 |

| Sheela Foam Limited | 1.90 |

| La Opala RG Limited | 1.79 |

| Amber Enterprises India Limited | 1.52 |

| TTK Prestige Limited | 1.04 |

| Dixon Technologies (India) Limited | 0.70 |

| Greenlam Industries Limited | 0.63 |

| Textile Products | 6.47 |

| ✔ Welspun India Limited | 2.76 |

| K.P.R. Mill Limited | 1.91 |

| Siyaram Silk Mills Limited | 0.92 |

| Himatsingka Seide Limited | 0.48 |

| S. P. Apparels Limited | 0.39 |

| Consumer Non Durables | 5.37 |

| VST Industries Limited | 1.95 |

| LT Foods Limited | 1.32 |

| Triveni Engineering & Industries Limited | 1.09 |

| Amrutanjan Health Care Limited | 0.68 |

| Dwarikesh Sugar Industries Limited | 0.33 |

| Finance | 4.73 |

| ✔ Manappuram Finance Limited | 3.01 |

| Muthoot Capital Services Limited | 0.74 |

| Repco Home Finance Limited | 0.51 |

| Equitas Holdings Limited | 0.47 |

| Construction | 4.17 |

| Cera Sanitaryware Limited | 1.85 |

| Kajaria Ceramics Limited | 1.53 |

| KNR Constructions Limited | 0.78 |

| Pesticides | 3.57 |

| ✔ Dhanuka Agritech Limited | 2.28 |

| Sharda Cropchem Limited | 1.29 |

| Fertilisers | 2.16 |

| Chambal Fertilizers & Chemicals Limited | 2.16 |

| Cement | 1.73 |

| Prism Johnson Limited | 0.94 |

| Star Cement Limited | 0.78 |

| Banks | 1.57 |

| DCB Bank Limited | 1.57 |

| Hotels, Resorts And Other Recreational Activities | 1.35 |

| Westlife Development Ltd | 1.35 |

| Healthcare Services | 1.19 |

| Narayana Hrudayalaya Ltd. | 1.19 |

| Textiles - Cotton | 1.14 |

| Vardhman Textiles Limited | 1.14 |

| Industrial Capital Goods | 1.10 |

| Voltamp Transformers Limited | 0.73 |

| Triveni Turbine Limited | 0.37 |

| Media & Entertainment | 1.09 |

| INOX Leisure Limited | 1.09 |

| Retailing | 0.79 |

| Shoppers Stop Limited | 0.79 |

| Software | 0.70 |

| eClerx Services Limited | 0.70 |

| Construction Project | 0.69 |

| Techno Electric & Engineering Company Limited | 0.69 |

| Telecom - Equipment & Accessories | 0.65 |

| Sterlite Technologies Limited | 0.65 |

| Total | 92.54 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 7.76 |

| Total | 7.76 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -0.30 |

| Total | -0.30 |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

✔ Top Ten Holdings

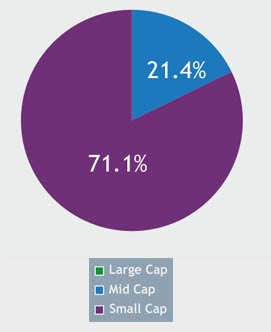

Classification of % of holdings based on Market Capitalisation: Mid Cap 21.42%, Small-Cap 71.12%.

Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms of

full market capitalization Small Cap: 251st company onwards in terms of full market capitalization

With effect from April 1, 2020, all lumpsum investments/subscriptions including all systematic investments in

units of the Scheme is accepted.

| Growth of Rs. 1 L invested at inception: | 6.00 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 15.10 | 5.51 | 6.23 | 16.42 | |

| Outperformed Benchmark TRI (calendar year) |

S&P BSE Smallcap TRI 77% |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | 10.6 | -1.0 | -13.1 | -68.5 |

| Maximum (%) | 29.4 | 35.5 | 55.4 | 214.0 |

| Average (%) | 18.8 | 20.6 | 19.8 | 21.1 |

| % times negative returns | -- | 0.6 | 12.3 | 37.4 |

| % of times returns are in excess of 7% | 100.0 | 89.6 | 74.5 | 52.4 |

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Increased |

| Pharmaceuticals |

| Aarti Drugs Limited |

| Ferrous Metals |

| Kalyani Steels Limited |

| Ratnamani Metals & Tubes Limited |

| Consumer Durables |

| Greenlam Industries Limited |

| TTK Prestige Limited |

| Textile Products |

| S. P. Apparels Limited |

| Fertilisers |

| Chambal Fertilizers & Chemicals Limited |

| Auto Ancillaries |

| Suprajit Engineering Limited |

| Lumax Auto Technologies Limited |

| Healthcare Services |

| Narayana Hrudayalaya Ltd. |

| Hotels, Resorts And Other Recreational Activities |

| Westlife Development Ltd |

| Cement |

| Prism Johnson Limited |

| Consumer Non Durables |

| VST Industries Limited |

| Industrial Products |

| Nilkamal Limited |

| Positions Decreased |

| Chemicals |

| Atul Limited |

| Ferrous Metals |

| APL Apollo Tubes Limited |

| Pharmaceuticals |

| JB Chemicals & Pharmaceuticals Limited |

Rebalances below 0.05 % are not considered.

The primary investment objective is

to seek to generate long term capital

appreciation from a portfolio that is

substantially constituted of equity and

equity related securities of small cap

companies. From time to time, the fund

manager will also seek participation in

other equity and equity related securities

to achieve optimal portfolio construction.

There is no assurance that the

investment objective of the Scheme will

be realized.

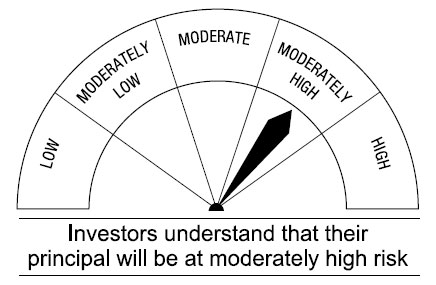

This Open Ended Equity Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Investment in equity and equity-related securities predominantly of small cap companies (beyond top 250

companies by market capitalization)

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.