|

DSP World Gold Fund An open ended fund of fund scheme investing in BlackRock Global Funds – World Gold Fund (BGF – WGF) |

|

|

- Fund of Fund scheme investing in units of BGF World Gold Fund.

- BGF World Gold Fund invests globally atleast 70% of its assets in the equity securities of companies predominantly engaged in gold-mining.

Jay Kothari

Total work experience of 16 years.

Managing this scheme since March

2013.

Fund of Funds

Sep 14, 2007

FTSE Gold Mine

| Regular Plan | |

| Growth: | ₹ 19.4766 |

| Direct Plan | |

| Growth: | ₹ 20.1886 |

₹ 832 Cr

₹ 877 Cr

| Regular Plan : | 2.43% | |

| Direct Plan : | 1.78% | |

| (Including TER of 1.01% of the underlying fund) | ||

| The investors are bearing the recurring expenses of the Fund, in addition to the expenses of the underlying Fund | ||

^Total TER is inclusive of the weighted average expenses levied by underlying schemes under regulation 52(6)(a) of SEBI (Mutual Funds) Regulations, 1996. | ||

13 Yr 1 Mn

| Standard Deviation : | 32.45% |

| Beta : | 0.94 |

| Sharpe Ratio : | 0.45 |

Nil

Data As On October 31, 2020

| DSP World Gold Fund (FOF) as on September 30, 2020 | % to Net Assets |

| BlackRock Global Funds - World Gold Fund (Class I2 USD Shares)^^ | 97.08 |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 4.73 |

| Net Receivables/Payables | -1.81 |

| TOTAL | 100.00 |

| BlackRock Global Funds - World Gold Fund (Underlying Fund) as on September 30, 2020 | |

| Top 10 stocks | |

| Security | % to Net Assets |

| BARRICK GOLD CORP | 9.5 |

| NEWMONT CORPORATION | 9.3 |

| KINROSS GOLD CORP | 5.4 |

| KIRKLAND LAKE GOLD LTD | 5.2 |

| GOLD FIELDS LTD | 4.4 |

| NEWCREST MINING LTD | 4.0 |

| B2GOLD CORP | 4.0 |

| WHEATON PRECIOUS METALS CORP | 3.8 |

| ENDEAVOUR MINING CORP | 3.6 |

| AGNICO EAGLE MINES LTD | 3.6 |

| OTHERS | 45.7 |

| Cash | 1.3 |

| Total | 100.00 |

| Sector Allocation | |

| Gold | 87.0 |

| Silver | 9.6 |

| Platinum Group Metals | 2.1 |

| Total | 98.72 |

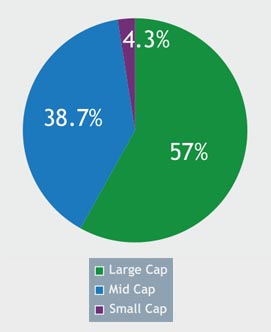

| Market Cap Allocation | |

| Large (>$10bn) | 57.0 |

| Mid | 38.7 |

| Small (<$1bn) | 4.3 |

| Total | 100.00 |

as on 30th Oct'20

^^Fund domiciled in Luxembourg

| Name of Instrument | % to Net Assets |

| OTHERS | |

| Foreign Securities | |

| BlackRock Global Funds - World Gold Fund (Class I2 USD Shares)^^ | 96.40 |

| Total | 96.40 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 3.61 |

| Total | 3.61 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | * |

| Total | * |

| GRAND TOTAL | 100.00 |

as on 30th Oct'20

^^Fund domiciled in Luxembourg

| Growth of Rs. 1 L invested at inception: | 1.95 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 7.98 | 18.16 | 29.51 | 5.98 | |

| Outperformed Benchmark TRI (calendar year) | FTSE Gold Mine - |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | -4.0 | -16.3 | -26.7 | -54.7 |

| Maximum (%) | 6.3 | 24.9 | 47.1 | 148.6 |

| Average (%) | -0.1 | -1.6 | 1.0 | 6.1 |

| % times negative returns | 54.1 | 64.4 | 37.7 | 52.0 |

| % of times returns are in excess of 7% | -- | 12.0 | 32.4 | 40.4 |

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

An open ended Fund of Funds

scheme seeking to generate

capital appreciation by investing

predominantly in units of BlackRock

Global Funds - World Gold Fund

(BGF-WGF). The Scheme may, at

the discretion of the Investment

Manager, also invest in the units of

other similar overseas mutual fund

schemes, which may constitute a

significant part of its corpus.

There is no assurance that the

investment objective of the

Scheme will be realized.

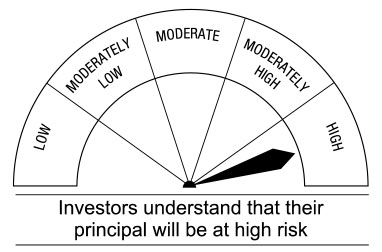

This Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Investment in units of overseas funds which invest primarily in equity and equity related securities

of gold mining Companies

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.