|

DSP Ultra Short Fund An open ended ultra-short term debt scheme investing in debt and money market securities such that the Macaulay duration of the portfolio is between 3 months and 6 months (please refer page no. 21 under the section “Where will the Scheme invest?” in the SID for details on Macaulay’s Duration) |

|

|

Enhanced cash fund

Suitable for investing surplus cash over short-term, alternative to on-demand deposits

Kedar Karnik

Total work experience of 14

years.

Managing this Scheme

since July 2016.

Ultra Short Duration

Jul 31, 2006

CRISIL Ultra Short Term Debt Index

| Regular Plan | |

| Growth: | ₹ 2674.1887 |

| Direct Plan | |

| Growth: | ₹ 2812.0883 |

₹ 2,859 Cr

₹ 2,822 Cr

| Regular Plan : | 1.01% |

| Direct Plan : | 0.29% |

0.44 years

> 3 months

| Modified Duration | 0.43 years |

| Yield To Maturity | 3.51% |

| Portfolio Macaulay Duration | 0.44 years |

Nil

Data As On October 31, 2020

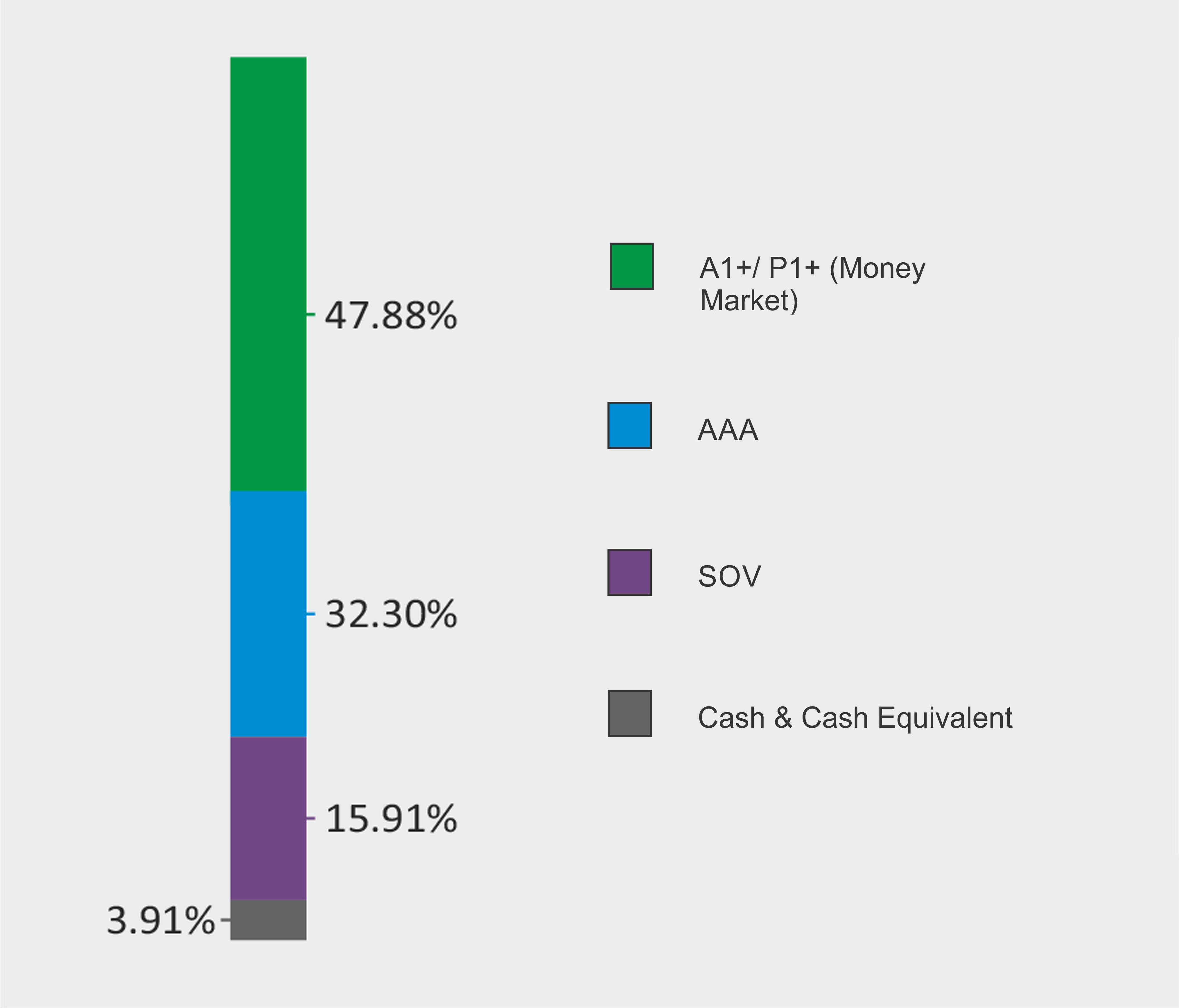

| Name of Instrument | Rating | % to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ REC Limited | CRISIL AAA | 7.27 |

| ✔ Power Finance Corporation Limited | CRISIL AAA | 7.10 |

| ✔ Housing Development Finance Corporation Limited | CRISIL AAA | 6.20 |

| ✔ LIC Housing Finance Limited | CRISIL AAA | 6.19 |

| Small Industries Development Bank of India | CARE AAA | 3.71 |

| LIC Housing Finance Limited | CARE AAA | 1.83 |

| Total | 32.30 | |

| Government Securities (Central/State) | ||

| ✔ 8.12% GOI 10-12-2020 | SOV | 5.55 |

| Total | 5.55 | |

| MONEY MARKET INSTRUMENTS | ||

| Certificate of Deposit | ||

| ✔ National Bank for Agriculture and Rural Development | IND A1+ | 5.38 |

| ✔ Small Industries Development Bank of India | CARE A1+ | 5.21 |

| ✔ ICICI Bank Limited | ICRA A1+ | 4.91 |

| Bank of Baroda | IND A1+ | 2.62 |

| Axis Bank Limited | ICRA A1+ | 1.74 |

| National Bank for Agriculture and Rural Development | CRISIL A1+ | 0.87 |

| Small Industries Development Bank of India | CRISIL A1+ | 0.86 |

| Total | 21.59 | |

| Commercial Papers | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ Reliance Industries Limited | CARE A1+ | 8.35 |

| Hero Fincorp Limited | CRISIL A1+ | 3.43 |

| Tata Capital Financial Services Limited | CRISIL A1+ | 3.41 |

| National Bank for Agriculture and Rural Development | IND A1+ | 2.62 |

| Julius Baer Capital (India) Private Limited | CRISIL A1+ | 2.58 |

| Housing Development Finance Corporation Limited | CRISIL A1+ | 2.28 |

| Deutsche Investments India Private Limited | CRISIL A1+ | 1.72 |

| National Bank for Agriculture and Rural Development | ICRA A1+ | 1.04 |

| Larsen & Toubro Limited | CRISIL A1+ | 0.86 |

| Total | 26.29 | |

| Treasury Bill | ||

| ✔ 182 DAY T-BILL 18032021 | SOV | 10.36 |

| Total | 10.36 | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 4.11 | |

| Total | 4.11 | |

| Cash & Cash Equivalent | ||

| Net Receivables/Payables | -0.20 | |

| Total | -0.20 | |

| GRAND TOTAL | 100.00 |

as on 30th Oct'20

✔ Top Ten Holdings

DSP Ultra Short Fund erstwhile known as DSP Money Manger Fund

Notes: 1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND.

2. Pursuant to SEBI circular SEBI/HO/IMD/DF4/CIR/P/2019/102 dated September 24, 2019 read with

circular no. SEBI/HO/IMD/DF4/CIR/P/2019/41 dated March 22, 2019. Below are the details of the

securities in case of which issuer has defaulted beyond its maturity date.

| Security | ISIN |

value of the security

considered under net

receivables (i.e. value

recognized in NAV in

absolute terms and as

% to NAV) (Rs.in lakhs) |

total amount

(including

principal and

interest) that

is due to the

scheme on that

investment (Rs.in lakhs) | |

| 0% IL&FS Transportation Networks Limited Ncd Series A 23032019 | INE975G08140 | 0.00 | 0.00% | 6,627.81 |

| Performance (CAGR Returns in %) | ||||

| 1 m | 3 m | 6 m | 1 yr | |

| 4.73 | 3.54 | 4.77 | 5.06 | |

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns are for Regular Plan - Growth Option Click here for performance in SEBI prescribed format.

An Open ended income Scheme,

seeking to generate returns

commensurate with risk from a

portfolio constituted of money

market securities and/or debt

securities.

There is no assurance that the

investment objective of the

Scheme will be realized.

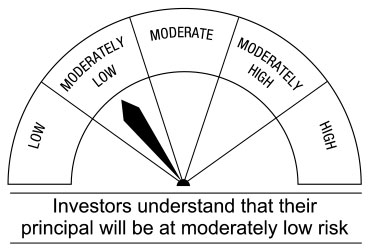

This Scheme is suitable for investors who are seeking*

• Income over a short-term investment horizon

• Investment in money market and debt securities

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.