|

DSP Banking & PSU Debt Fund An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. |

|

|

Short duration fund with 100% AAA portfolio of predominantly Banks and govt. owned companies

Suitable for investor seeking a short duration (~2 years), 100% AAA portfolio invested in predominantly bank and govt. owned companies

Vikram Chopra

Total work experience of 18

years.

Managing this Scheme

since July 2016.

Saurabh Bhatia

Total work experience of 19

years.

Managing this Scheme

since February 2018.

Banking and PSU

Sep 14, 2013

Nifty Banking & PSU Debt Index

| Regular Plan | |

| Growth: | ₹ 18.4961 |

| Direct Plan | |

| Growth: | ₹ 18.9203 |

₹ 4,422 Cr

₹ 4,401 Cr

| Regular Plan : | 0.54% |

| Direct Plan : | 0.32% |

3.56 years

1 year +

| Modified Duration | 2.95 years |

| Yield To Maturity | 4.92% |

| Portfolio Macaulay Duration | 3.06 years |

Nil

Data As On October 31, 2020

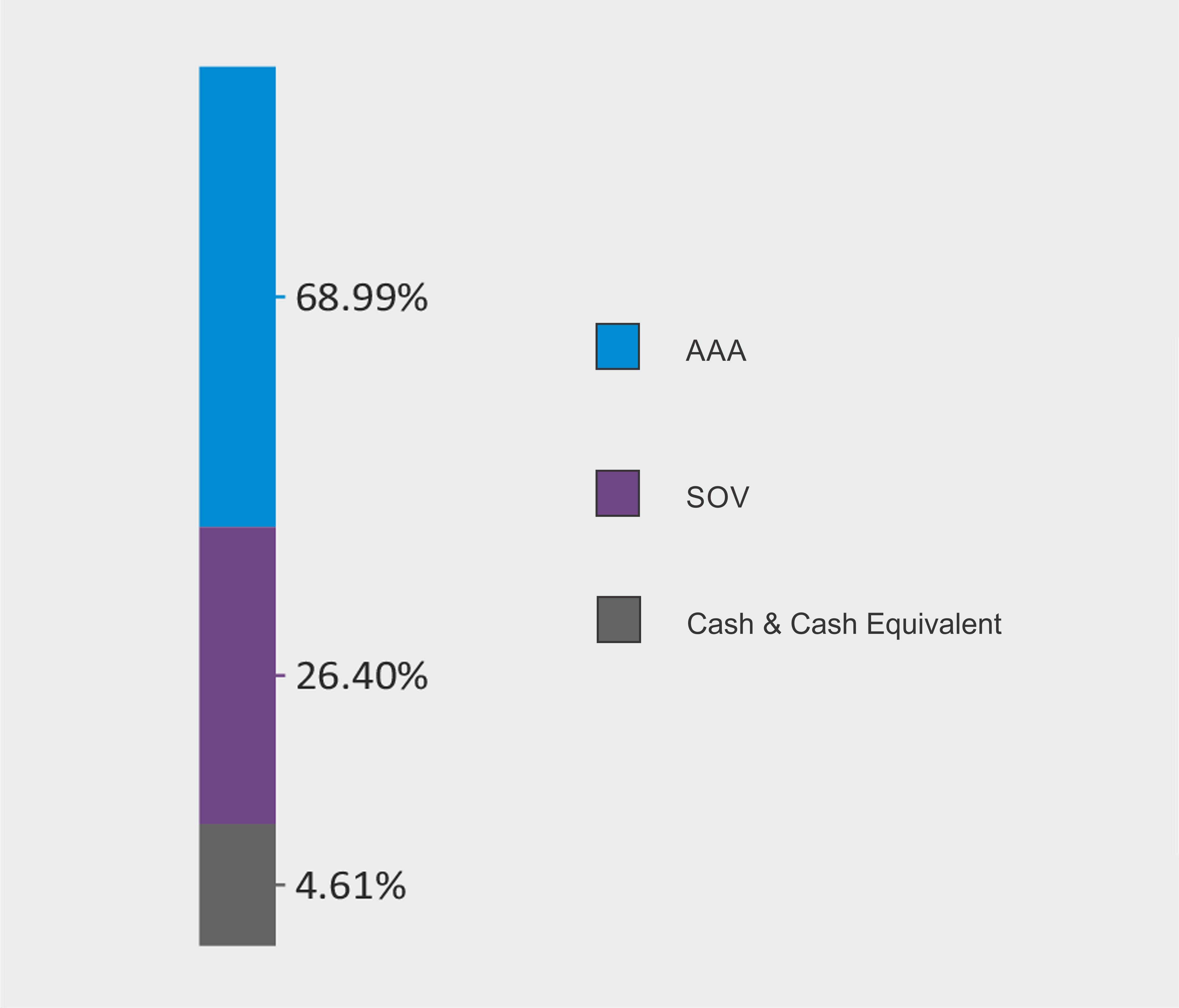

| Name of Instrument | Rating | % to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ Hindustan Petroleum Corporation Limited | CRISIL AAA | 8.96 |

| ✔ NTPC Limited | CARE AAA | 7.67 |

| ✔ National Housing Bank | CRISIL AAA | 7.04 |

| ✔ Indian Oil Corporation Limited | CRISIL AAA | 6.89 |

| ✔ National Bank for Agriculture and Rural Development | ICRA AAA | 5.86 |

| ✔ Power Finance Corporation Limited | CARE AAA | 5.35 |

| Power Grid Corporation of India Limited | CRISIL AAA | 3.60 |

| National Bank for Agriculture and Rural Development | CRISIL AAA | 3.26 |

| Indian Railway Finance Corporation Limited | CARE AAA | 3.01 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 2.65 |

| REC Limited | CRISIL AAA | 2.46 |

| Oil & Natural Gas Corporation Limited | ICRA AAA | 2.03 |

| National Highways Authority of India | CRISIL AAA | 1.90 |

| Small Industries Development Bank of India | ICRA AAA | 1.84 |

| Export-Import Bank of India | CRISIL AAA | 1.72 |

| REC Limited | CARE AAA | 1.25 |

| Housing Development Finance Corporation Limited | CRISIL AAA | 1.11 |

| NHPC Limited | CARE AAA | 0.89 |

| Small Industries Development Bank of India | CARE AAA | 0.69 |

| Power Grid Corporation of India Limited | CARE AAA | 0.29 |

| NTPC Limited | CRISIL AAA | 0.26 |

| NHPC Limited | IND AAA | 0.13 |

| GAIL (India) Limited | CARE AAA | 0.13 |

| Total | 68.99 | |

| Government Securities (Central/State) | ||

| ✔ 6.79% GOI 15-05-2027 | SOV | 7.51 |

| ✔ 7.17% GOI 08-01-2028 | SOV | 6.72 |

| ✔ 7.26% GOI 14-01-2029 | SOV | 5.86 |

| ✔ 7.27% GOI 08-04-2026 | SOV | 4.13 |

| 7.59% GOI 11-01-2026 | SOV | 2.03 |

| 7.64% Gujarat SDL 08-11-2027 | SOV | 0.13 |

| 8.48% Karnataka SDL 17-10-2022 | SOV | 0.02 |

| Total | 26.40 | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 2.90 | |

| Total | 2.90 | |

| Cash & Cash Equivalent | ||

| Cash Margin | 0.12 | |

| Net Receivables/Payables | 1.59 | |

| Total | 1.71 | |

| GRAND TOTAL | 100.00 |

as on 30th Oct'20

✔ Top Ten Holdings

Notes: 1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND.

| Performance (CAGR Returns in %) | ||||

| 1 yr | 3 yr | 5 yr | SI* | |

| 10.29 | 8.56 | 8.53 | 9.01 | |

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns are for Regular Plan - Growth Option Click here for performance in SEBI prescribed format.

The primary investment objective

of the Scheme is to seek to

generate income and capital

appreciation by primarily investing

in a portfolio of high quality debt

and money market securities that

are issued by banks and public

sector entities/ undertakings.

There is no assurance that the

investment objective of the

Scheme will be realized.

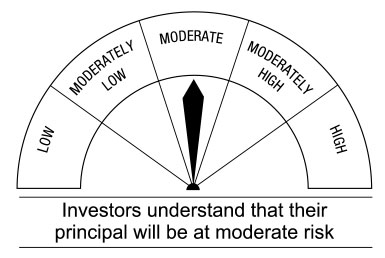

This Scheme is suitable for investors who are seeking*

• Income over a short-term investment horizon

• Investment in money market and debt securities issued by banks and public sector undertakings,

public financial institutions and Municipal Bonds

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.