An open ended equity scheme following economic reforms and/or Infrastructure development theme

|

DSP India T.I.G.E.R. Fund (The Infrastructure Growth and Economic Reforms) An open ended equity scheme following economic reforms and/or Infrastructure development theme |

|

|

Rohit Singhania

Total work experience of 19 years.

Managing this Scheme since June 2010

Jay Kothari (Dedicated Fund

Manager for overseas investments)

Total work experience of 16 years.

Managing this Scheme since

March 2018.

June 11, 2004

S&P BSE 100 (TRI)

| Regular Plan | |

| Growth: | ₹ 87.991 |

| Direct Plan | |

| Growth: | ₹ 91.933 |

₹ 855 Cr

₹ 822 Cr

0.83

| Standard Deviation : | 27.33% |

| Beta : | 1.16 |

| R-Squared : | 85.07% |

| Sharpe Ratio : | -0.29 |

| Regular Plan : | 2.45% |

| Direct Plan : | 1.82% |

Sectoral/Thematic

16 Yr 5 Mn

Holding period <12 months: 1%

Holding period >=12 months: Nil

Data As On November 27, 2020

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Banks | 16.76 |

| ✔ ICICI Bank Limited | 8.25 |

| ✔ HDFC Bank Limited | 5.17 |

| ✔ State Bank of India | 3.34 |

| Industrial Capital Goods | 9.51 |

| ✔ Siemens Limited | 2.34 |

| ABB India Limited | 1.94 |

| Bharat Electronics Limited | 1.94 |

| Thermax Limited | 1.45 |

| Honeywell Automation India Limited | 1.22 |

| Voltamp Transformers Limited | 0.63 |

| Industrial Products | 8.60 |

| Carborundum Universal Limited | 1.51 |

| Bharat Forge Limited | 1.48 |

| Orient Refractories Limited | 1.21 |

| Finolex Cables Limited | 1.05 |

| Grindwell Norton Limited | 1.05 |

| AIA Engineering Limited | 0.90 |

| KEI Industries Limited | 0.83 |

| Supreme Industries Limited | 0.59 |

| Cement | 7.42 |

| ✔ UltraTech Cement Limited | 3.32 |

| ✔ ACC Limited | 2.66 |

| JK Lakshmi Cement Limited | 1.44 |

| Construction Project | 6.30 |

| ✔ Larsen & Toubro Limited | 3.10 |

| H.G. Infra Engineering Limited | 1.29 |

| Ashoka Buildcon Limited | 1.02 |

| Techno Electric & Engineering Company Limited | 0.89 |

| Construction | 5.98 |

| ✔ KNR Constructions Limited | 3.17 |

| Ahluwalia Contracts (India) Limited | 1.50 |

| PNC Infratech Limited | 1.30 |

| Telecom - Services | 5.74 |

| ✔ Bharti Airtel Limited | 5.74 |

| Consumer Durables | 5.07 |

| Crompton Greaves Consumer Electricals Limited | 1.90 |

| Blue Star Limited | 1.28 |

| Voltas Limited | 1.10 |

| Century Plyboards (India) Limited | 0.78 |

| Power | 4.95 |

| Power Grid Corporation of India Limited | 1.77 |

| Tata Power Company Limited | 1.15 |

| NTPC Limited | 1.07 |

| CESC Limited | 0.97 |

| Ferrous Metals | 4.24 |

| Tata Steel Limited | 1.90 |

| Ratnamani Metals & Tubes Limited | 1.60 |

| APL Apollo Tubes Limited | 0.74 |

| Finance | 3.89 |

| Manappuram Finance Limited | 1.52 |

| LIC Housing Finance Limited | 1.22 |

| Housing Development Finance Corporation Limited | 1.10 |

| Satin Creditcare Network Limited - Partly Paid Shares | 0.05 |

| Gas | 3.89 |

| Indraprastha Gas Limited | 1.49 |

| Gujarat Gas Limited | 1.35 |

| Gujarat State Petronet Limited | 1.04 |

| Petroleum Products | 3.70 |

| Hindustan Petroleum Corporation Limited | 1.43 |

| Bharat Petroleum Corporation Limited | 1.17 |

| Reliance Industries Limited | 1.02 |

| Reliance Industries Limited - Partly Paid Shares | 0.09 |

| Transportation | 3.40 |

| Gujarat Pipavav Port Limited | 1.84 |

| Container Corporation of India Limited | 1.57 |

| Non - Ferrous Metals | 2.83 |

| Hindalco Industries Limited | 1.70 |

| Hindustan Zinc Limited | 1.13 |

| Fertilisers | 2.27 |

| ✔ Chambal Fertilizers & Chemicals Limited | 2.27 |

| Auto Ancillaries | 1.30 |

| Exide Industries Limited | 1.30 |

| Chemicals | 1.00 |

| Solar Industries India Limited | 1.00 |

| Textile Products | 0.95 |

| Welspun India Limited | 0.95 |

| Media & Entertainment | 0.49 |

| INOX Leisure Limited | 0.49 |

| Total | 98.32 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 0.52 |

| Total | 0.52 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | 1.16 |

| Total | 1.16 |

| GRAND TOTAL | 100.00 |

as on 27th Nov'20

✔ Top Ten Holdings

| Growth of Rs. 1 L invested at inception: | 8.80 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 7.76 | 3.25 | 2.18 | 9.34 | |

| Outperformed Benchmark TRI (calendar year) |

S&P BSE 100 TRI 36% |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | 2.2 | -5.7 | -13.4 | -60.8 |

| Maximum (%) | 19.8 | 31.6 | 69.0 | 118.8 |

| Average (%) | 10.6 | 11.2 | 12.5 | 17.8 |

| % times negative returns | -- | 9.8 | 19.5 | 35.5 |

| % of times returns are in excess of 7% | 83.3 | 67.5 | 63.4 | 55.7 |

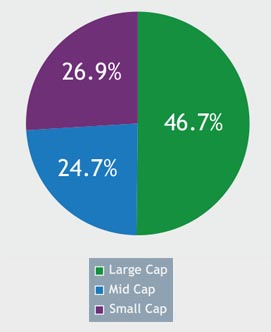

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Industrial Capital Goods |

| BEML Limited |

| Construction Project |

| Dilip Buildcon Limited |

| New Position Bought |

| Consumer Durables |

| Century Plyboards (India) Limited |

| Industrial Products |

| Supreme Industries Limited |

| Media & Entertainment |

| INOX Leisure Limited |

| Positions Increased |

| Industrial Products |

| AIA Engineering Limited |

| Orient Refractories Limited |

| Grindwell Norton Limited |

| Industrial Capital Goods |

| Voltamp Transformers Limited |

| Honeywell Automation India Limited |

| Gas |

| Indraprastha Gas Limited |

| Consumer Durables |

| Crompton Greaves Consumer Electricals Limited |

| Positions Decreased |

| Consumer Durables |

| Voltas Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Auto Ancillaries |

| Exide Industries Limited |

| Construction Project |

| H.G. Infra Engineering Limited |

| Ashoka Buildcon Limited |

| Fertilisers |

| Chambal Fertilizers & Chemicals Limited |

| Industrial Capital Goods |

| Thermax Limited |

| Ferrous Metals |

| APL Apollo Tubes Limited |

| Tata Steel Limited |

| Power |

| NTPC Limited |

| Tata Power Company Limited |

| Banks |

| HDFC Bank Limited |

| ICICI Bank Limited |

| State Bank of India |

| Finance |

| Satin Creditcare Network Limited |

| Housing Development Finance Corporation Limited |

Rebalances below 0.25% are not considered.

The primary investment objective

of the Scheme is to seek to generate

capital appreciation, from a portfolio

that is substantially constituted of

equity securities and equity related

securities of corporates, which could

benefit from structural changes brought

about by continuing liberalization in

economic policies by the Government

and/ or from continuing investments in

infrastructure, both by the public and

private sector.

There is no assurance that the

investment objective of the Scheme

will be realized.

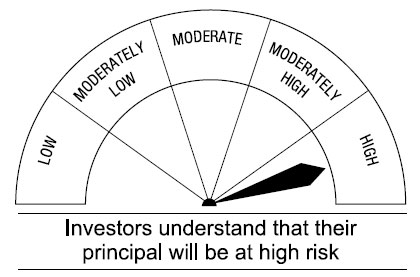

This Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Investment in equity and equity-related securities of corporates, which could benefit from structural changes

brought about by continuing liberalization in economic policies by the Government and/or from continuing

Investments in infrastructure, both by the public and private sector

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.