|

DSP Equity Savings Fund An open ended scheme investing in equity, arbitrage and debt |

|

|

- Invests in 1/3rd each Equity, Arbitrage And Debt providing equity taxation.

- The overall portfolio captures some upside potential from pure equities with significantly lower volatility due to debt, therefore has the potential to generate better returns per unit of risk with an equity taxation structure.

Vinit Sambre (Equity portion)

Total work experience of 21

years Managing the Scheme

since June 2020

Saurabh Bhatia (Debt Portion)

Total work experience of 19

years. Managing this Scheme

since March 2018.

Jay Kothari (Dedicated

Fund Manager for overseas

investments)

Total work experience of 16 years.

Managing this Scheme since

March 2018.

Mar 28, 2016

30% Nifty 500 TRI + 70% CRISIL Liquid

Fund Index

(The benchmark assumes quarterly rebalancing)

| Regular Plan | |

| Growth: | ₹ 13.776 |

| Direct Plan | |

| Growth: | ₹ 14.737 |

₹ 394 Cr

₹ 397 Cr

4.19

| Standard Deviation : | 11.44% |

| Beta : | 1.65 |

| R-Squared : | 90.63% |

| Sharpe Ratio : | 0.04 |

| Regular Plan : | 2.40% |

| Direct Plan : | 0.86% |

0.91 years

0.81 years

4.71%

0.85 years

Conservative Hybrid

4 Yr 8 Mn

• If the units redeemed or switched out are upto

10% of the units (the limit) purchased or switchedin

within 12 months from the date of allotment: Nil

• If units redeemed or switched out are in excess

of the limit within 12 months from the date of

allotment: 1%

• If units are redeemed or switched out on or after

12 months from the date of allotment: NIL.

@@Computed on the invested amount for debt portfolio

Data As On November 27, 2020

| Name of Instrument | % to Net Assets | |

| EQUITY & EQUITY RELATED | ||

| Listed / awaiting listing on the stock exchanges | ||

| Banks | 7.66 | |

| ✔ HDFC Bank Limited | 3.96 | |

| ✔ ICICI Bank Limited | 2.77 | |

| Kotak Mahindra Bank Limited | 0.93 | |

| Pharmaceuticals | 4.84 | |

| ✔ IPCA Laboratories Limited | 2.58 | |

| ✔ Cipla Limited | 2.26 | |

| Consumer Durables | 4.71 | |

| ✔ Voltas Limited | 2.41 | |

| Crompton Greaves Consumer Electricals Limited | 1.36 | |

| V-Guard Industries Limited | 0.94 | |

| Software | 4.69 | |

| ✔ Infosys Limited | 2.91 | |

| Tata Consultancy Services Limited | 1.78 | |

| Finance | 4.56 | |

| Bajaj Finance Limited | 1.77 | |

| Max Financial Services Limited | 1.33 | |

| HDFC Life Insurance Company Limited | 0.83 | |

| ICICI Lombard General Insurance Company Limited | 0.63 | |

| Consumer Non Durables | 3.98 | |

| ✔ Dabur India Limited | 2.25 | |

| Hatsun Agro Product Limited | 1.73 | |

| Cement | 1.94 | |

| UltraTech Cement Limited | 1.06 | |

| Shree Cement Limited | 0.88 | |

| Auto Ancillaries | 1.92 | |

| Balkrishna Industries Limited | 1.20 | |

| Exide Industries Limited | 0.72 | |

| Textile Products | 1.76 | |

| Welspun India Limited | 1.76 | |

| Telecom - Services | 1.56 | |

| Bharti Airtel Limited | 1.56 | |

| Chemicals | 0.89 | |

| Atul Limited | 0.89 | |

| Gas | 0.88 | |

| Gujarat State Petronet Limited | 0.88 | |

| Services | 0.77 | |

| Quess Corp Limited | 0.77 | |

| Industrial Products | 0.19 | |

| Wim Plast Ltd. | 0.19 | |

| Total | 40.35 | |

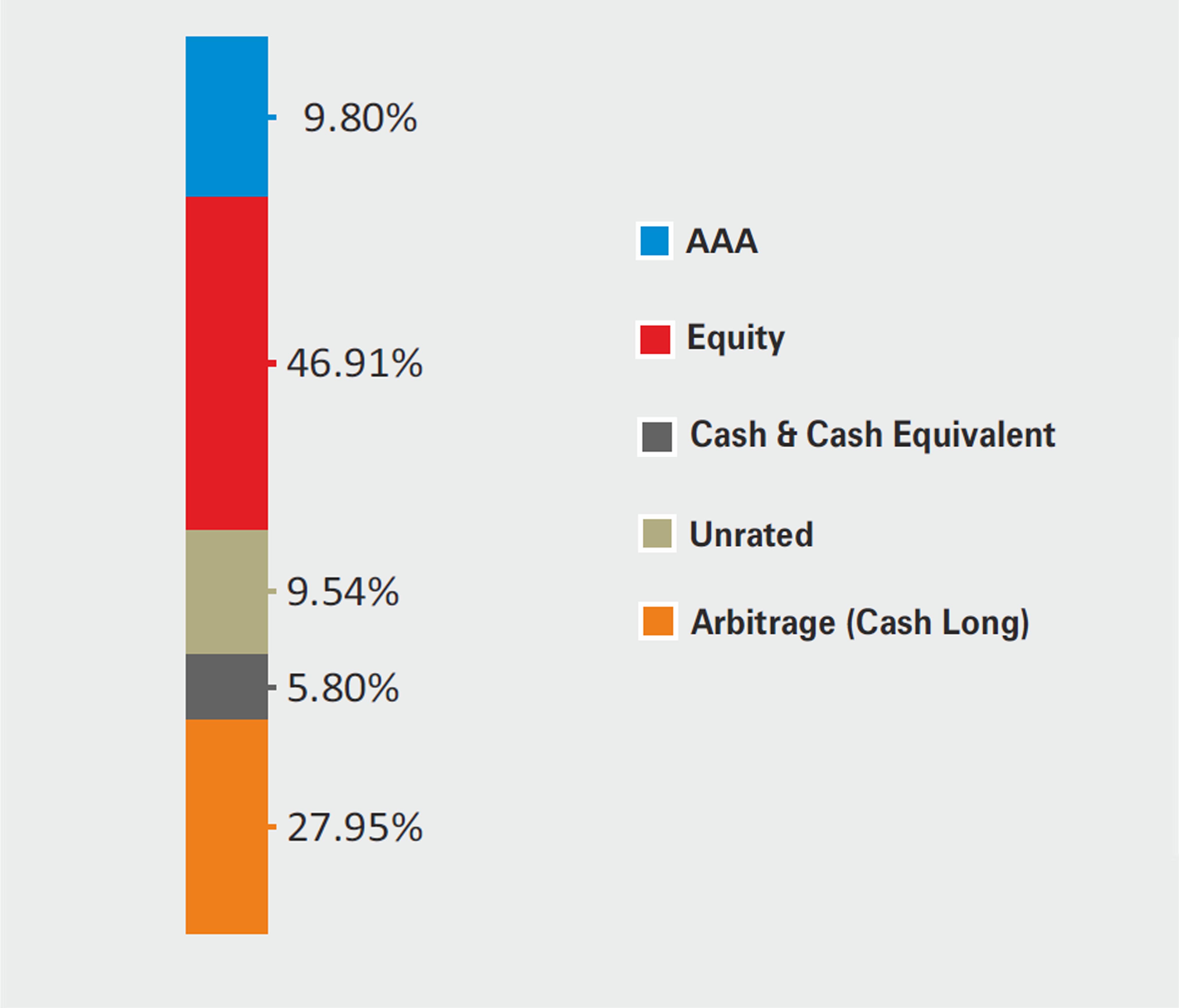

| Arbitrage (Cash Long) | ||

| Stock Futures | -28.11 | |

| Total | 27.95 | |

| Units issued by REITs & InvITs | ||

| Listed / awaiting listing on the stock exchanges | ||

| Finance | 6.56 | |

| ✔ India Grid Trust | 6.56 | |

| Total | 6.56 | |

| Name of Instrument | Rating | to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ Reliance Industries Limited | CARE AAA | 6.93 |

| ✔ Power Finance Corporation Limited | CRISIL AAA | 2.87 |

| Total | 9.80 | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 4.43 | |

| Total | 4.43 | |

| Fixed Deposit | ||

| ICICI Bank Limited 23 Feb 2021 (Duration - 397 Days) | Unrated | 0.53 |

| ICICI Bank Limited 24 Feb 2021 (Duration - 397 Days) | Unrated | 0.53 |

| Bank of Baroda 02 Feb 2021 (Duration - 377 Days) | Unrated | 0.53 |

| Bank of Baroda 04 Feb 2021 (Duration - 379 Days) | Unrated | 0.53 |

| Bank of Baroda 29 Jan 2021 (Duration - 373 Days) | Unrated | 0.53 |

| Bank of Baroda 01 Feb 2021 (Duration - 376 Days) | Unrated | 0.53 |

| Bank of Baroda 03 Feb 2021 (Duration - 378 Days) | Unrated | 0.53 |

| Bank of Baroda 09 Feb 2021 (Duration - 383 Days) | Unrated | 0.53 |

| Bank of Baroda 11 Feb 2021 (Duration - 385 Days) | Unrated | 0.53 |

| Bank of Baroda 10 Feb 2021 (Duration - 384 Days) | Unrated | 0.53 |

| Bank of Baroda 18 Feb 2021 (Duration - 391 Days) | Unrated | 0.53 |

| Bank of Baroda 17 Feb 2021 (Duration - 390 Days) | Unrated | 0.53 |

| Bank of Baroda 16 Feb 2021 (Duration - 389 Days) | Unrated | 0.53 |

| Bank of Baroda 18 Mar 2021 (Duration - 405 Days) | Unrated | 0.53 |

| Bank of Baroda 23 Mar 2021 (Duration - 410 Days) | Unrated | 0.53 |

| Bank of Baroda 19 Mar 2021 (Duration - 406 Days) | Unrated | 0.53 |

| Bank of Baroda 22 Mar 2021 (Duration - 409 Days) | Unrated | 0.53 |

| Bank of Baroda 17 Mar 2021 (Duration - 404 Days) | Unrated | 0.53 |

| Total | 9.54 | |

| Cash & Cash Equivalent | ||

| Cash Margin | 1.68 | |

| Net Receivables/Payables | -0.31 | |

| Total | 1.37 | |

| GRAND TOTAL | 100.00 |

as on 27th Nov'20

✔ Top Ten Holdings

Notes : 1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND.

| Growth of Rs. 1 L invested at inception: | 1.38 L |

| SIP Returns(In %) | ||||

| 3 yr | SI* | |||

| 6.70 | 6.12 | |||

| Outperformed Benchmark TRI (calendar year) |

70% CRISIL Liquid Fund

Index + 30% Nifty 500 TRI 25% |

| 3 yr | 1 yr | |

| Minimum (%) | -1.6 | -13.5 |

| Maximum (%) | 8.1 | 17.1 |

| Average (%) | 4.3 | 4.8 |

| % times negative returns (%) | 4.6 | 24.4 |

| % of times returns are in excess of 7% | 16.7 | 40.3 |

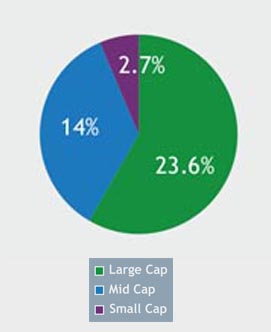

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Consumer Non Durables |

| Asian Paints Limited |

| Hindustan Unilever Limited |

| Auto Ancillaries |

| Minda Industries Limited |

| New Position Bought |

| Cement |

| UltraTech Cement Limited |

Rebalances below 0.25% are not considered.

An Open ended equity Scheme,

seeking to generate income through

investments in fixed income

ecurities and using arbitrage and

other derivative Strategies. The

Scheme also intends to generate

long-term capital appreciation by

investing a portion of the scheme's

assets in equity and equity related

instruments.

There is no assurance that the

investment objective of the

Scheme will be realized.

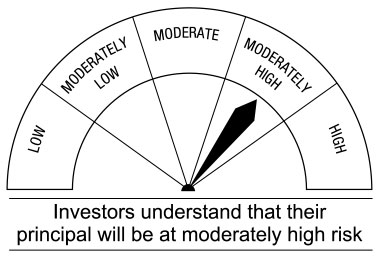

This Scheme is suitable for investors who are seeking*

• Long term capital growth and income

• Investment in equity and equity related securities including the use of equity derivatives strategies and

arbitrage opportunities with balance exposure in debt and money market instruments

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.