|

DSP Nifty 50 Index Fund An open ended scheme replicating / tracking NIFTY 50 Index |

|

|

Invests in top 50 companies of the country by market cap

These companies have emerged as leaders in their sector post going through multiple business and economic cycles

Anil Ghelani

Total work experience of 21 years.

Managing this Scheme since

July 2019.

February 21, 2019

NIFTY 50 (TRI)

| Regular Plan | |

| Growth: | ₹ 09.5804 |

| Direct Plan | |

| Growth: | ₹ 09.6074 |

₹ 59 Cr

₹ 59 Cr

0.66

| Regular Plan : | 0.39% |

| Direct Plan : | 0.21% |

Nil

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Banks | 24.41 |

| ✔ HDFC Bank Limited | 10.46 |

| ✔ ICICI Bank Limited | 5.16 |

| ✔ Kotak Mahindra Bank Limited | 4.51 |

| Axis Bank Limited | 2.08 |

| State Bank of India | 1.55 |

| IndusInd Bank Limited | 0.65 |

| Yes Bank Limited# | * |

| Software | 13.93 |

| ✔ Infosys Limited | 6.11 |

| ✔ Tata Consultancy Services Limited | 4.96 |

| HCL Technologies Limited | 1.37 |

| Tech Mahindra Limited | 0.76 |

| Wipro Limited | 0.74 |

| Petroleum Products | 13.41 |

| ✔ Reliance Industries Limited | 12.23 |

| Bharat Petroleum Corporation Limited | 0.68 |

| Indian Oil Corporation Limited | 0.49 |

| Consumer Non Durables | 12.33 |

| ✔ Hindustan Unilever Limited | 4.41 |

| ✔ ITC Limited | 3.85 |

| Asian Paints Limited | 1.72 |

| Nestle India Limited | 1.39 |

| Britannia Industries Limited | 0.96 |

| Finance | 9.37 |

| ✔ Housing Development Finance Corporation Limited | 6.87 |

| Bajaj Finance Limited | 1.70 |

| Bajaj Finserv Limited | 0.80 |

| Auto | 5.43 |

| Maruti Suzuki India Limited | 1.76 |

| Mahindra & Mahindra Limited | 1.11 |

| Bajaj Auto Limited | 0.83 |

| Hero MotoCorp Limited | 0.75 |

| Eicher Motors Limited | 0.58 |

| Tata Motors Limited | 0.40 |

| Telecom - Services | 3.04 |

| ✔ Bharti Airtel Limited | 3.04 |

| Pharmaceuticals | 2.98 |

| Sun Pharmaceutical Industries Limited | 1.16 |

| Dr. Reddy's Laboratories Limited | 1.08 |

| Cipla Limited | 0.74 |

| Construction Project | 2.61 |

| Larsen & Toubro Limited | 2.61 |

| Cement | 2.27 |

| UltraTech Cement Limited | 1.02 |

| Shree Cement Limited | 0.70 |

| Grasim Industries Limited | 0.55 |

| Power | 2.07 |

| NTPC Limited | 1.05 |

| Power Grid Corporation of India Limited | 1.02 |

| Ferrous metals | 0.99 |

| Tata Steel Limited | 0.55 |

| JSW Steel Limited | 0.44 |

| Non - Ferrous metals | 0.92 |

| Hindalco Industries Limited | 0.48 |

| Vedanta Limited | 0.44 |

| Consumer Durables | 0.90 |

| Titan Company Limited | 0.90 |

| Oil | 0.67 |

| Oil & Natural Gas Corporation Limited | 0.67 |

| Minerals/Mining | 0.63 |

| Coal India Limited | 0.63 |

| Transportation | 0.59 |

| Adani Ports and Special Economic Zone Limited | 0.59 |

| Pesticides | 0.53 |

| UPL Limited | 0.53 |

| Gas | 0.43 |

| GAIL (India) Limited | 0.43 |

| Telecom - Equipment & Accessories | 0.43 |

| Bharti Infratel Limited | 0.43 |

| Media & Entertainment | 0.35 |

| Zee Entertainment Enterprises Limited | 0.35 |

| Total | 98.29 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 0.46 |

| Total | 0.46 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | 1.25 |

| Total | 1.25 |

| GRAND TOTAL | 100.00 |

✔ Top Ten Holdings

* Less than 0.01%

Subject to SEBI (MF) Regulations and the applicable guidelines issued by SEBI, Scheme has entered into securities

lending in accordance with the framework specified in this regard.

Reconstituted Portfolio#

As per the guidance note issued by AMFI vide correspondence 35P/MEM-COR/57/2019-20 any realization of

proceeds from the locked-in shares of Yes Bank Ltd. (post conclusion of the lock in period) shall be distributed

among the set of investors existing in the unit holders’ register / BENPOS as on end of March 13, 2020.

| Positions Increased |

| Consumer Non Durables |

| Hindustan Unilever Limited |

| Positions Decreased |

| Telecom - Services |

| Bharti Airtel Limited |

| Media & Entertainment |

| Zee Entertainment Enterprises Limited |

| Oil |

| Oil & Natural Gas Corporation Limited |

| Minerals/Mining |

| Coal India Limited |

| Consumer Durables |

| Titan Company Limited |

| Gas |

| GAIL (India) Limited |

| Telecom - Equipment & Accessories |

| Bharti Infratel Limited |

| Pesticides |

| UPL Limited |

| Construction Project |

| Larsen & Toubro Limited |

| Transportation |

| Adani Ports and Special Economic Zone Limited |

| Non - Ferrous Metals |

| Hindalco Industries Limited |

| Vedanta Limited |

| Power |

| Power Grid Corporation of India Limited |

| NTPC Limited |

| Ferrous Metals |

| JSW Steel Limited |

| Tata Steel Limited |

| Cement |

| Shree Cement Limited |

| Grasim Industries Limited |

| UltraTech Cement Limited |

| Finance |

| Housing Development Finance Corporation Limited |

| Bajaj Finserv Limited |

| Bajaj Finance Limited |

| Pharmaceuticals |

| Dr. Reddy's Laboratories Limited |

| Cipla Limited |

| Sun Pharmaceutical Industries Limited |

| Petroleum Products |

| Indian Oil Corporation Limited |

| Bharat Petroleum Corporation Limited |

| Reliance Industries Limited |

| Consumer Non Durables |

| Britannia Industries Limited |

| Asian Paints Limited |

| ITC Limited |

| Nestle India Limited |

| Software |

| Tech Mahindra Limited |

| Wipro Limited |

| Infosys Limited |

| HCL Technologies Limited |

| Tata Consultancy Services Limited |

| Banks |

| Kotak Mahindra Bank Limited |

| HDFC Bank Limited |

| ICICI Bank Limited |

| Axis Bank Limited |

| IndusInd Bank Limited |

| State Bank of India |

| Auto |

| Bajaj Auto Limited |

| Hero MotoCorp Limited |

| Tata Motors Limited |

| Mahindra & Mahindra Limited |

| Eicher Motors Limited |

| Maruti Suzuki India Limited |

Rebalances below 0.05 % are not considered.

The investment objective of the

Scheme is to generate returns

that are commensurate with the

performance of the NIFTY 50 Index,

subject to tracking error.

However, there is no assurance that the objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns.

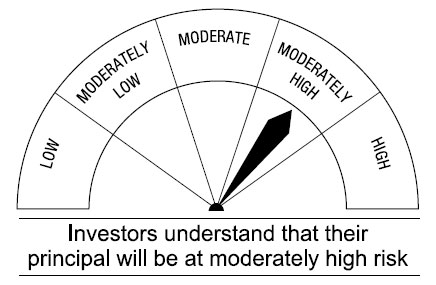

This open ended equity Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Returns that are commensurate with the performance of NIFTY 50 Index, subject to tracking error.

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.