|

DSP Healthcare Fund An open ended equity scheme investing in healthcare and pharmaceutical sector |

|

|

Aditya Khemka

Total work experience of 11 years.

Managing this Scheme since

November 2018.

Vinit Sambre

Total work experience of 19 years.

Managing this Scheme since

November 2018.

Jay Kothari (Dedicated Fund

Manager for overseas investments)

Total work experience of 14 years.

Managing this Scheme since

November 2018.

Nov 30, 2018

S&P BSE HEALTHCARE (TRI)

| Regular Plan | |

| Growth: | ₹ 13.643 |

| Direct Plan | |

| Growth: | ₹ 14.038 |

₹ 475 Cr

₹ 452 Cr

0.19

| Regular Plan : | 2.56% |

| Direct Plan : | 1.04% |

Holding period <12 months: 1%

Holding period >=12 months: Nil

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Pharmaceuticals | 72.02 |

| ✔ IPCA Laboratories Limited | 10.03 |

| ✔ Dr. Reddy's Laboratories Limited | 8.44 |

| ✔ JB Chemicals & Pharmaceuticals Limited | 8.31 |

| ✔ Divi's Laboratories Limited | 7.39 |

| ✔ Cipla Limited | 4.64 |

| ✔ Aarti Drugs Limited | 4.28 |

| ✔ Jubilant Life Sciences Limited | 4.25 |

| ✔ Torrent Pharmaceuticals Limited | 3.80 |

| ✔ Procter & Gamble Health Limited | 3.69 |

| ✔ Indoco Remedies Limited | 3.56 |

| Alembic Pharmaceuticals Limited | 3.55 |

| Unichem Laboratories Limited | 2.42 |

| Syngene International Limited | 2.42 |

| Abbott India Limited | 2.09 |

| Ajanta Pharma Limited | 1.63 |

| Alkem Laboratories Limited | 1.54 |

| Healthcare Services | 10.62 |

| Narayana Hrudayalaya Ltd. | 3.12 |

| Dr. Lal Path Labs Ltd. | 2.97 |

| Max Healthcare Institute Ltd | 1.99 |

| Apollo Hospitals Enterprise Limited | 1.69 |

| Advaita Allied Health Services Limited | 0.85 |

| Finance | 1.75 |

| ICICI Lombard General Insurance Company Limited | 1.75 |

| Total | 84.41 |

| Foreign Securities and/or overseas ETF(s) | |

| Listed / awaiting listing on the stock exchanges | |

| Pharmaceuticals | 5.50 |

| Abbott Laboratories | 3.24 |

| Intuitive Surgical Inc | 2.26 |

| Healthcare Services | 2.48 |

| Abiomed Inc | 2.48 |

| Total | 7.98 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 7.75 |

| Total | 7.75 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -0.14 |

| Total | -0.14 |

| GRAND TOTAL | 100.00 |

✔ Top Ten Holdings

| Positions Exited |

| Pharmaceuticals |

| Sun Pharmaceutical Industries Limited |

| Healthcare Services |

| Max India Limited |

| New Position Bought |

| Healthcare Services |

| Max Healthcare Institute Ltd |

| Advaita Allied Health Services Limited |

| Positions Increased |

| Pharmaceuticals |

| Cipla Limited |

| Procter & Gamble Health Limited |

| IPCA Laboratories Limited |

| Divi's Laboratories Limited |

| Dr. Reddy's Laboratories Limited |

| Healthcare Services |

| Dr. Lal Path Labs Ltd. |

| Narayana Hrudayalaya Ltd. |

Rebalances below 0.05 % are not considered.

The primary investment objective of the

scheme is to seek to generate consistent

returns by predominantly investing in

equity and equity related securities of

pharmaceutical and healthcare companies.

However, there can be no assurance that

the investment objective of the scheme will

be realized.

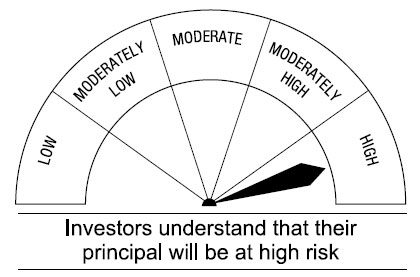

This open ended equity Scheme is suitable for investors who are seeking*

• Long term capital growth

• Investment in equity and equity related Securities of healthcare and pharmaceutical companies

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.