|

DSP Bond Fund An open ended medium term debt scheme investing in debt and money market securities such that the Macaulay duration of the portfolio is between 3 years and 4 years (please refer page no. 32 under the section “Where will the Scheme invest” for details on Macaulay’s Duration) |

|

|

Medium duration high credit quality (100% in AA and better rated securities)

Suitable for investor seeking medium duration (~3 yrs), high credit quality (100% in AA or better) portfolio; alternative to traditional >=3 yr term deposits

Saurabh Bhatia

Total work experience of 16 years.

Managing this Scheme since February 2018.

Medium Duration

Apr 29, 1997

CRISIL Medium Term Debt Index

| Regular Plan | |

| Growth: | ₹ 61.5622 |

| Direct Plan | |

| Growth: | ₹ 64.2132 |

₹ 251 Cr

₹ 246 Cr

| Regular Plan : | 0.76% |

| Direct Plan : | 0.40% |

4.96 years

> 3years +

251

| Modified Duration | 3.54 years |

| Yield To Maturity | 5.85% |

NIL

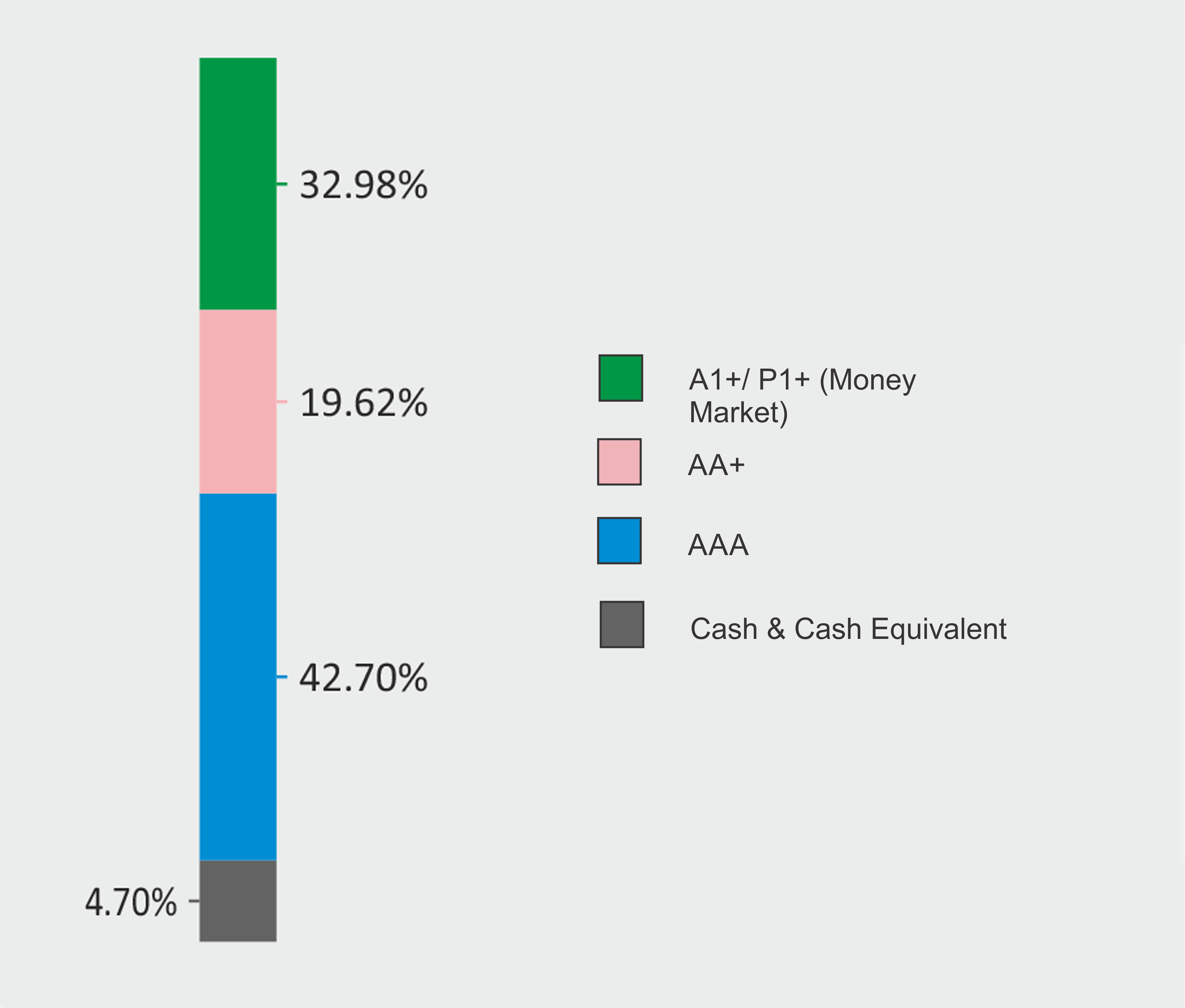

| Name of Instrument | Rating | % to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ State Bank of India | CRISIL AA+ | 9.49 |

| ✔ NTPC Limited | CRISIL AAA | 9.43 |

| ✔ National Bank for Agriculture and Rural Development | ICRA AAA | 9.39 |

| ✔ National Highways Authority of India | CRISIL AAA | 8.90 |

| ✔ Housing Development Finance Corporation Limited | CRISIL AAA | 8.12 |

| ✔ Bank of Baroda | CRISIL AA+ | 6.42 |

| Indian Railway Finance Corporation Limited | CARE AAA | 4.70 |

| Export-Import Bank of India | CRISIL AA+ | 3.71 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 2.15 |

| Total | 62.31 | |

| MONEY MARKET INSTRUMENTS | ||

| Certificate of Deposit | ||

| ✔ ICICI Bank Limited | ICRA A1+ | 7.82 |

| ✔ Axis Bank Limited | CRISIL A1+ | 7.79 |

| ✔ Small Industries Development Bank of India | CARE A1+ | 7.66 |

| Export-Import Bank of India | CRISIL A1+ | 1.95 |

| Total | 25.22 | |

| Commercial Paper | ||

| ✔ Reliance Industries Limited | CARE A1+ | 7.76 |

| Total | 7.76 | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 2.10 | |

| Total | 2.10 | |

| Cash & Cash Equivalent | ||

| Net Receivables/Payables | 2.61 | |

| Total | 2.61 | |

| GRAND TOTAL | 100.00 |

✔ Top Ten Holdings

Notes: 1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND.

2. Pursuant to SEBI circular SEBI/HO/IMD/DF4/CIR/P/2019/102 dated September 24, 2019 read with

circular no. SEBI/HO/IMD/DF4/CIR/P/2019/41 dated March 22, 2019. Below are the details of the

securities in case of which issuer has defaulted beyond its maturity date.

| Security | ISIN | value of the security considered under net receivables (i.e. value recognized in NAV in absolute terms and as % to NAV) | total amount (including principal and interest) that is due to the scheme on that investment | |

| 0% Il&Fs Transportation Networks Limited NCD Series A 23032019 | INE975G08140 | 0.00 | 0.00% | 1,325.56 |

| 9.10% Dewan Housing Finance Corporation Limited NCD Series N7 Sr. 4A 16082019 | INE202B07HQ0 | 643.68 | 2.57% | 2,618.40 |

| Performance (CAGR Returns in %) | ||||

| 1 yr | 3 yr | 5 yr | SI | |

| SI - Since inception | 10.38 | 5.25 | 6.92 | 8.15 |

The primary investment

objective of the Scheme is to

seek to generate an attractive

return, consistent with prudent

risk, from a portfolio which

is substantially constituted of

high quality debt securities,

predominantly of issuers

domiciled in India. This shall

be the fundamental attribute

of the Scheme. As a secondary

objective, the Scheme will

seek capital appreciation. The

Scheme will also invest a certain

portion of its corpus in money

market securities, in order to

meet liquidity requirements

from time to time.

There is no

assurance that the investment

objective of the Scheme will be

realized.

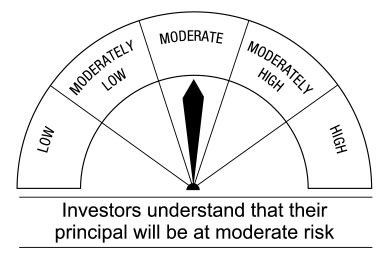

This Scheme is suitable for investors who are seeking*

• Income over a medium-term investment horizon

• Investment in money market and debt securities

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.