|

DSP Overnight Fund An Open Ended Debt Scheme Investing in Overnight Securities |

|

|

Invests in overnight securities having maturity of 1 day

Suitable for investors needing high liquidity and relatively lower risk investments to invest surplus cash over the short-term (min 1 day)

Kedar Karnik

Total work experience of 13 years.

Managing this Scheme since

January 2019.

Jan 9, 2019

CRISIL Overnight Index

| Regular Plan | |

| Growth: | ₹ 1078.6114 |

| Direct Plan | |

| Growth: | ₹ 1080.1832 |

₹ 2,599 Cr

₹ 2,583 Cr

| Regular Plan : | 0.16% |

| Direct Plan : | 0.09% |

0.01 years

0.00 years

3.30%

0.00 years

Nil

| Name of Instrument | % to Net Assets |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 99.79 |

| Total | 99.79 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | 0.21 |

| Total | 0.21 |

| GRAND TOTAL | 100.00 |

As per the investment policy of DSP Overnight Fund , the Fund does not invest in Corporate Debt Repo

The primary objective of the

scheme is to seek to generate

returns commensurate with low

risk and providing high level of

liquidity, through investments

made primarily in overnight

securities having maturity of 1

business day.

There is no assurance that the

investment objective of the

Scheme will be realized.

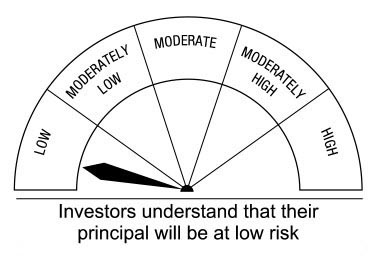

This open ended debt scheme is suitable for investor who are seeking*

• reasonable returns with high levels of safety and convenience of liquidity over short term

• Investment in debt and money market instruments having maturity of upto 1 business day

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.