|

DSP Regular Savings Fund An open ended hybrid scheme investing predominantly in debt instruments |

|

|

- Conservative Hybrid scheme investing predominantly in fixed income instruments.

- Potential to earn returns greater than fixed income and suitable for investors with an investment horizon of 3 years and above.

Vikram Chopra (Debt portion)

Total work experience of 17 years.

Managing this Scheme since

July 2016.

Jay Kothari (Dedicated Fund

Manager for overseas investments)

Total work experience of 14 years.

Managing this Scheme since

March 2018.

Gopal Agrawal (Equity portion)

Total work experience of 20 years.

Managing this Scheme since

August 2018

Conservative Hybrid

Jun 11, 2004

CRISIL Hybrid 85+15-Conservative Index

| Regular Plan | |

| Growth: | ₹ 37.2037 |

| Direct Plan | |

| Growth: | ₹ 39.7458 |

₹ 233 Cr

₹ 237 Cr

| Regular Plan : | 2.22% |

| Direct Plan : | 0.59% |

2.61 years

> 3 years +

233

| Modified Duration@@ | 2.12 years |

| Yield To Maturity@@ | 7.44% |

Holding Period: < 12 months: 1%~

Holding Period: >= 12 months: Nil

~If the units redeemed or switched out are upto 10%

of the units (thelimit) purchased or switched: Nil.

| Name of Instrument | % to Net Assets | |

| EQUITY & EQUITY RELATED | ||

| Listed / awaiting listing on the stock exchanges | ||

| Finance | 4.97% | |

| ✔ Bajaj Finance Limited | 3.21% | |

| ICICI Lombard General Insurance Company Limited | 0.77% | |

| HDFC Life Insurance Company Limited | 0.37% | |

| Satin Creditcare Network Limited | 0.33% | |

| L&T Finance Holdings Limited | 0.29% | |

| Banks | 4.73% | |

| ✔ HDFC Bank Limited | 2.63% | |

| AU Small Finance Bank Limited | 0.76% | |

| Kotak Mahindra Bank Limited | 0.58% | |

| RBL Bank Limited | 0.50% | |

| IndusInd Bank Limited | 0.26% | |

| Consumer Durables | 3.55% | |

| Blue Star Limited | 1.52% | |

| Voltas Limited | 0.88% | |

| V-Guard Industries Limited | 0.74% | |

| Crompton Greaves Consumer Electricals Limited | 0.41% | |

| Pharmaceuticals | 1.84% | |

| IPCA Laboratories Limited | 0.88% | |

| Eris Lifesciences Limited | 0.51% | |

| Sun Pharmaceutical Industries Limited | 0.44% | |

| Consumer Non Durables | 1.56% | |

| Nestle India Limited | 0.62% | |

| Britannia Industries Limited | 0.48% | |

| Hatsun Agro Product Limited | 0.46% | |

| Auto Ancillaries | 1.42% | |

| Balkrishna Industries Limited | 0.58% | |

| Minda Industries Limited | 0.54% | |

| Motherson Sumi Systems Limited | 0.31% | |

| Gas | 1.18% | |

| GAIL (India) Limited | 0.80% | |

| Gujarat State Petronet Limited | 0.39% | |

| Petroleum Products | 1.11% | |

| Bharat Petroleum Corporation Limited | 0.47% | |

| Castrol India Limited | 0.34% | |

| Hindustan Petroleum Corporation Limited | 0.30% | |

| Industrial Products | 0.53% | |

| Cummins India Limited | 0.38% | |

| Wim Plast Ltd. | 0.15% | |

| Cement | 0.51% | |

| Shree Cement Limited | 0.51% | |

| Power | 0.51% | |

| NTPC Limited | 0.51% | |

| Media & Entertainment | 0.45% | |

| Music Broadcast Limited | 0.25% | |

| Sun TV Network Limited | 0.19% | |

| Construction Project | 0.40% | |

| Larsen & Toubro Limited | 0.40% | |

| Industrial Capital Goods | 0.31% | |

| Bharat Electronics Limited | 0.31% | |

| Auto | 0.29% | |

| Ashok Leyland Limited | 0.29% | |

| Services | 0.25% | |

| Quess Corp Limited | 0.25% | |

| Ferrous metals | 0.19% | |

| Tata Steel Limited | 0.18% | |

| Tata Steel Limited - Partly Paid Shares | * | |

| Oil | 0.16% | |

| Oil & Natural Gas Corporation Limited | 0.16% | |

| Non - Ferrous metals | 0.09% | |

| Vedanta Limited | 0.09% | |

| Software | 0.02% | |

| CESC Ventures Limited | 0.02% | |

| Retailing | 0.02% | |

| Spencer's Retail Limited | 0.02% | |

| Total | 24.08% | |

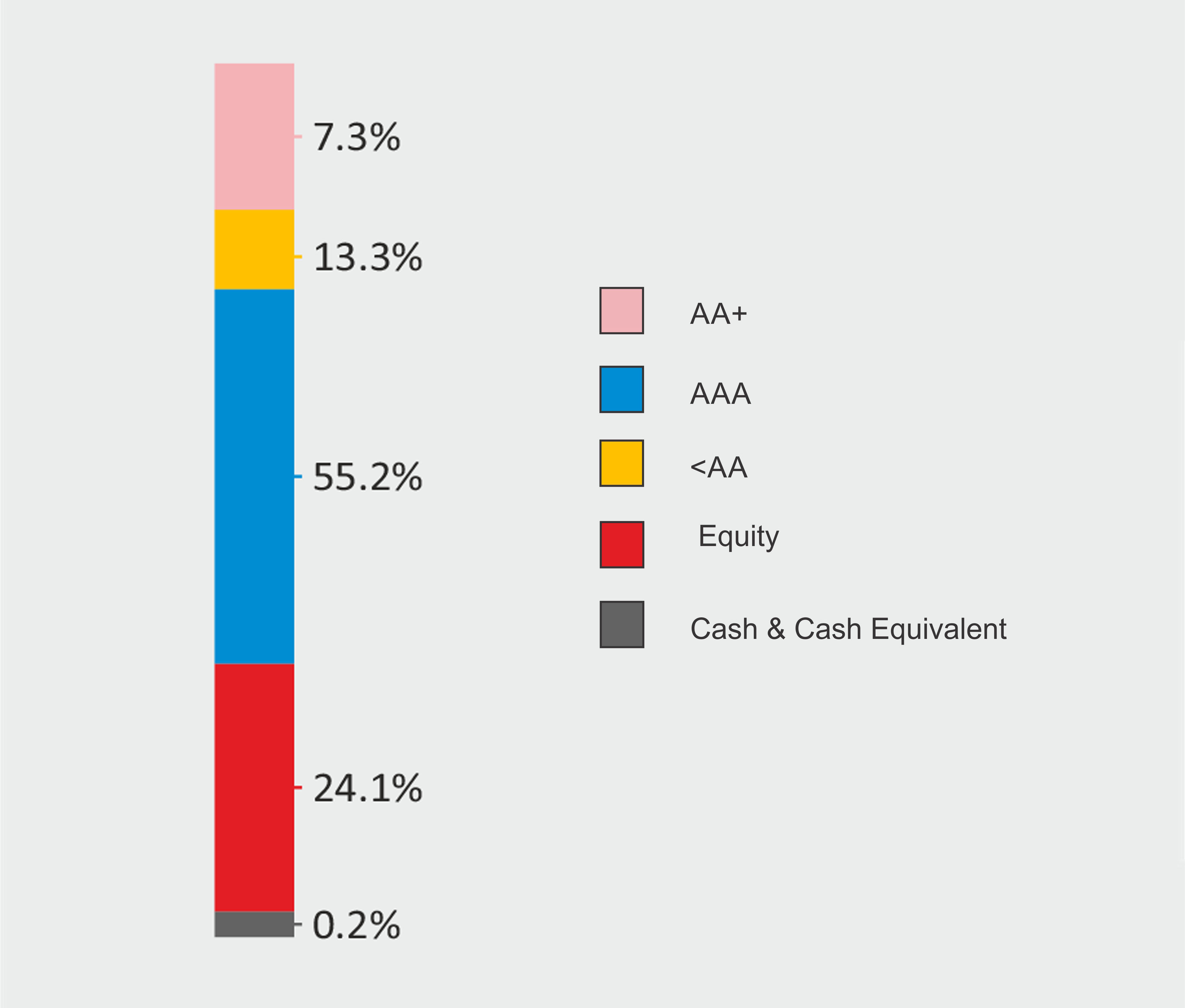

| Name of Instrument | Rating | "% to Net Assets" |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ Hindustan Petroleum Corporation Limited | CRISIL AAA | 9.08% |

| ✔ Power Grid Corporation of India Limited | CRISIL AAA | 8.88% |

| ✔ REC Limited | CRISIL AAA | 8.73% |

| ✔ State Bank of India | CRISIL AA+ | 7.27% |

| ✔ National Highways Authority of India | CRISIL AAA | 7.08% |

| ✔ National Bank for Agriculture and Rural Development | CRISIL AAA | 6.73% |

| ✔ East-North Interconnection Company Limited | CRISIL AAA | 4.52% |

| Power Finance Corporation Limited | CRISIL AAA | 2.38% |

| Small Industries Development Bank of India | CARE AAA | 2.26% |

| GAIL (India) Limited | CARE AAA | 2.23% |

| Export-Import Bank of India | CRISIL AAA | 2.20% |

| NTPC Limited | CRISIL AAA | 1.07% |

| Total | 62.43% | |

| Unlisted | ||

| ✔ KKR India Financial Services Private Limited | CRISIL AA | 13.29% |

| Total | 13.29% | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 0.30% | |

| Total | 0.30% | |

| Cash & Cash Equivalent | ||

| Net Receivables/Payables | -0.10% | |

| Total | -0.10% | |

| GRAND TOTAL | 100.00% |

✔ Top Ten Holdings

* Less than 0.01%

DSP Regular Savings Fund erstwhile known as DSP MIP Fund (Monthly income is not assured and is subject to

availability of distributable surplus)

@@Computed on the invested amount for debt portfolio

Notes:1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND.

2. Pursuant to SEBI circular SEBI/HO/IMD/DF4/CIR/P/2019/102 dated September 24, 2019 read with

circular no. SEBI/HO/IMD/DF4/CIR/P/2019/41 dated March 22, 2019. Below are the details of the

securities in case of which issuer has defaulted beyond its maturity date.

| Security | ISIN |

value of the security

considered under net

receivables (i.e. value

recognized in NAV in

absolute terms and as

% to NAV) (Rs.in lakhs) |

total amount

(including

principal and

interest) that

is due to the

scheme on that

investment (Rs.in lakhs) | |

| 0% IL&FS Transportation Networks Limited Ncd Series A 23032019 | INE975G08140 | 0.00 | 0.00% | 1,855.79 |

| Performance (CAGR Returns in %) | ||||

| 1 yr | 3 yr | 5 yr | SI | |

| SI - Since inception | 8.18 | 3.51 | 5.14 | 8.71 |

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns are for Regular Plan - Growth Option Click here for performance in SEBI prescribed format.

An Open Ended Income Scheme,

seeking to generate income,

consistent with prudent risk, from

a portfolio which is substantially

constituted of quality debt

securities. The scheme will

also seek to generate capital

appreciation by investing a smaller

portion of its corpus in equity and

equity related securities of issuers

domiciled in India.

There is no assurance that the

investment objective of the

Scheme will be realized.

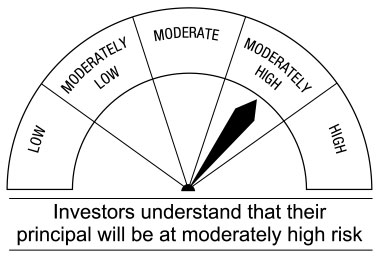

This Open Ended conservative hybrid scheme is suitable for investors who are seeking*

• Income and capital growth over a medium-term investment horizon

• Investment predominantly in debt securities, with balance exposure in equity/equity-related securities

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.