|

DSP Natural Resources and New Energy Fund An open ended equity scheme investing in Natural Resources and Alternative Energy sector |

|

|

Rohit Singhania

Total work experience of 18 years.

Managing this Scheme since July

2012.

Jay Kothari (Dedicated Fund

Manager for overseas investments)

Total work experience of 14 years.

Managing this Scheme since March

2013.

Apr 25, 2008

35% S&P BSE Oil & Gas Index + 30%

S&P BSE Metal Index + 35% MSCI

World Energy 10/40 Net Total Return

(The benchmark assumes quarterly rebalancing)

| Regular Plan | |

| Growth: | ₹ 26.709 |

| Direct Plan | |

| Growth: | ₹ 27.985 |

₹ 282 Cr

₹ 317 Cr

0.41

| Standard Deviation : | 18.23% |

| Beta : | 1.00 |

| R-Squared : | 76.75% |

| Sharpe Ratio : | -0.47 |

| Regular Plan : | 2.48% |

| Direct Plan : | 1.74% |

| (Including TER of 0.10% of the underlying fund) | |

Sectoral/Thematic

11 Yr 10 Mn

| AUM as on 28 February 2020 (₹ in Cr) | 282 |

Nil

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Petroleum Products | 25.21% |

| ✔ Reliance Industries Limited | 9.88% |

| ✔ Bharat Petroleum Corporation Limited | 6.75% |

| Hindustan Petroleum Corporation Limited | 4.38% |

| Indian Oil Corporation Limited | 4.19% |

| Non - Ferrous metals | 19.27% |

| ✔ Hindalco Industries Limited | 8.59% |

| ✔ Vedanta Limited | 6.90% |

| Hindustan Zinc Limited | 3.78% |

| Minerals/Mining | 14.31% |

| ✔ Coal India Limited | 9.30% |

| ✔ NMDC Limited | 5.01% |

| Gas | 10.35% |

| ✔ GAIL (India) Limited | 6.14% |

| Petronet LNG Limited | 4.21% |

| Ferrous metals | 10.07% |

| ✔ Tata Steel Limited | 6.77% |

| JSW Steel Limited | 3.30% |

| Oil | 9.08% |

| ✔ Oil & Natural Gas Corporation Limited | 9.08% |

| Commercial Services | 0.62% |

| South West Pinnacle Exploration Limited | 0.62% |

| Consumer Non Durables | 0.58% |

| Triveni Engineering & Industries Limited | 0.58% |

| Total | 89.48% |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 2.44% |

| Total | 2.44% |

| OTHERS | |

| Foreign Securities | |

| ✔ BlackRock Global Funds - Sustainable Energy Fund (Class I2 USD Shares)^^ | 9.40% |

| Total | 9.40% |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -1.32% |

| Total | -1.32% |

| GRAND TOTAL | 100.00% |

✔ Top Ten Holdings

^^Fund domiciled in Luxembourg

| Growth of Rs. 1 L invested at inception: | 2.67 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| *SI - Since inception | 7.87 | 1.28 | (12.23) | 8.84 |

| Outperformed Benchmark TRI (calendar year) |

35% S&P BSE Oil & Gas Index TRI +30%

S&P BSE Metal Index TRI + 35% MSCI

World Energy 10/40 Net Total Return*

45% *The benchmark assumes quarterly rebalancing |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum | 8.1 | -0.2 | -11.4 | -23.9 |

| Maximum | 18.1 | 27.9 | 36.2 | 112.9 |

| Average | 13.0 | 13.0 | 13.7 | 17.0 |

| % times negative returns | -- | 0.1 | 14.2 | 38.5 |

| % of times returns are in excess of 7% | 100.0 | 77.0 | 71.9 | 50.7 |

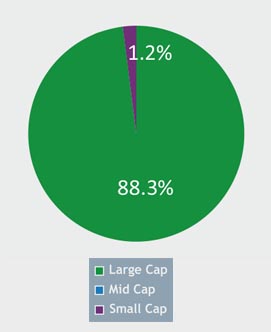

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Stock |

| Gas |

| Mahanagar Gas Limited |

| Positions Increased |

| Stock |

| Oil |

| Oil & Natural Gas Corporation Limited |

| Positions Decreased |

| Stock |

| Petroleum Products |

| Indian Oil Corporation Limited |

| Bharat Petroleum Corporation Limited |

| Hindustan Petroleum Corporation Limited |

| Gas |

| Petronet LNG Limited |

| Non - Ferrous Metals |

| Vedanta Limited |

| Hindalco Industries Limited |

| Minerals/Mining |

| NMDC Limited |

| Ferrous Metals |

| Tata Steel Limited |

| JSW Steel Limited |

| Steel Authority of India Limited |

Rebalances below 0.05 % are not considered.

The primary investment objective of

the Scheme is seeking to generate long

term capital appreciation and provide

long term growth opportunities by

investing in equity and equity related

securities of companies domiciled in

India whose pre-dominant economic

activity is in the: a) discovery,

development, production, or

distribution of natural resources, viz.,

energy, mining etc; (b) alternative

energy and energy technology sectors,

with emphasis given to renewable

energy, automotive and on-site

power generation, energy storage

and enabling energy technologies.

The Scheme will also invest a

certain portion of its corpus in the

equity and equity related securities

of companies domiciled overseas,

which are principally engaged in the

discovery, development, production or

distribution of natural resources and

alternative energy and/or the units/

shares of BlackRock Global Funds –

Sustainable Energy Fund, BlackRock

Global Funds – World Energy Fund and

similar other overseas mutual fund

schemes.

The secondary objective is to generate

consistent returns by investing in debt

and money market securities.

There is no assurance that the

investment objective of the Scheme

will be realized.

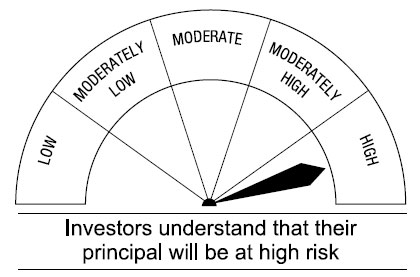

This Open Ended Equity Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Investment in equity and equity-related securities of natural resources companies in sectors like mining,

energy, etc. and companies involved in alternative energy and energy technology and also, investment in

units of overseas funds which invest in such companies overseas

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.