|

DSP Government Securities Fund An open ended debt scheme investing in government securities across maturity |

|

|

Active duration management (only sovereign securities)

Suitable for investor seeking high quality strategic fixed income allocation for investment horizon of >5 years; invests in sovereign debt only

Vikram Chopra

Total work experience of 17 years.

Managing this Scheme since

July 2016.

Saurabh Bhatia

Total work experience of 16 years.

Managing this Scheme since

March 2018.

Gilt

Sep 30, 1999

ICICI Securities Li-Bex

| Regular Plan | |

| Growth: | ₹ 70.9248 |

| Direct Plan | |

| Growth: | ₹ 73.5677 |

₹ 833 Cr

₹ 1,174 Cr

| Regular Plan : | 1.03% |

| Direct Plan : | 0.56% |

9.14 years

> 5 years +

833

| Modified Duration | 6.27 years |

| Yield To Maturity | 5.63% |

| Portfolio Macaulay Duration | 6.47 years |

Nil

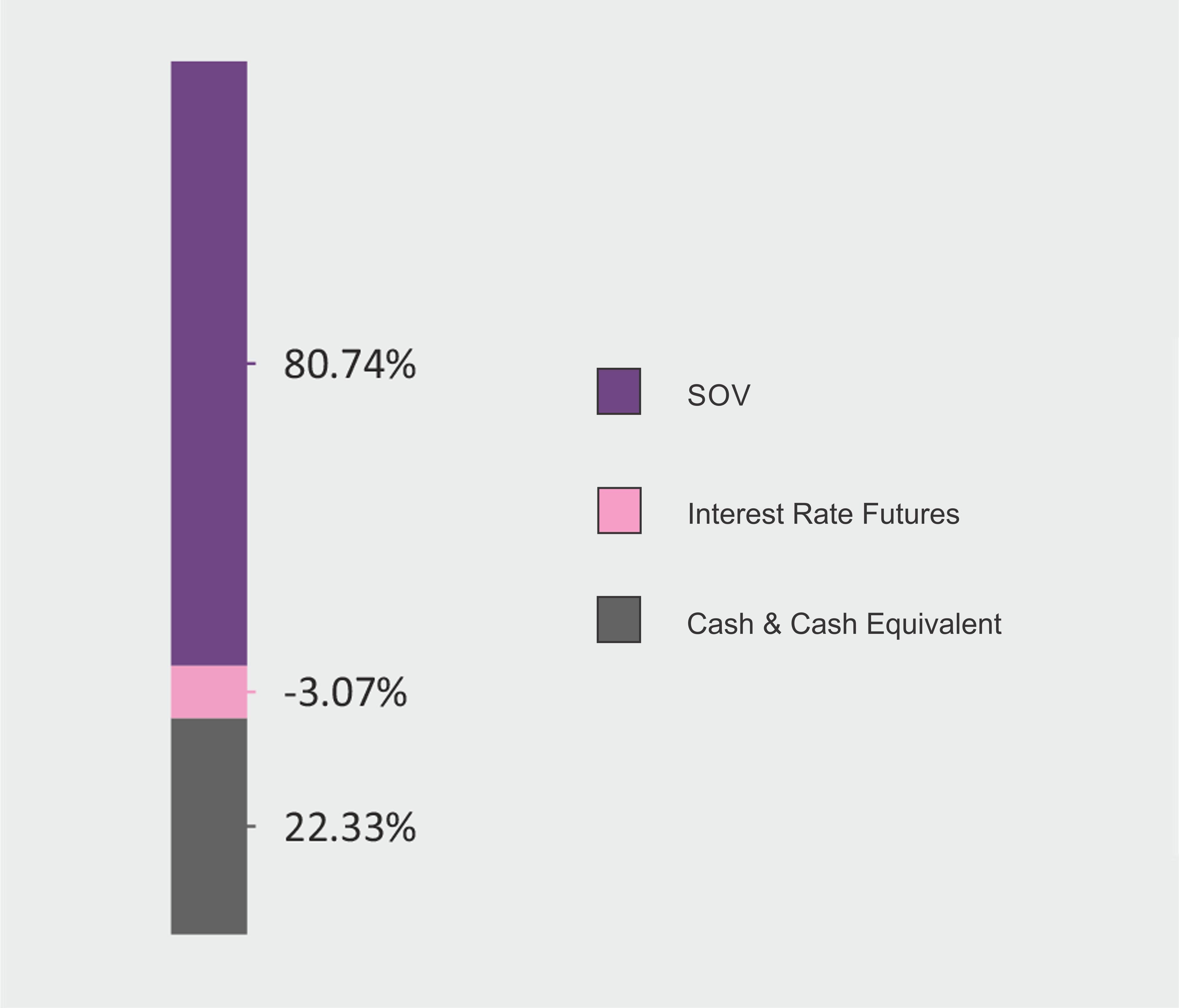

| Name of Instrument | Rating | % to Net Assets |

| Arbitrage | ||

| Interest Rate Futures | -3.07 | |

| Total | -3.07 | |

| DEBT INSTRUMENTS | ||

| Government Securities (Central/state) | ||

| 6.19% GOI 16-09-2034 | SOV | 41.65 |

| 5.77% GOI 03-08-2030 | SOV | 25.27 |

| 7.27% GOI 08-04-2026 | SOV | 13.82 |

| Total | 80.74 | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 0.66 | |

| Total | 0.66 | |

| Cash & Cash Equivalent | ||

| Cash Margin | 0.42 | |

| Net Receivables/Payables | 18.18 | |

| Total | 18.60 | |

| GRAND TOTAL | 100.00 |

| Performance (CAGR Returns in %) | ||||

| 1 yr | 3 yr | 5 yr | SI | |

| SI - Since inception | 10.38 | 8.56 | 9.40 | 9.81 |

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns are for Regular Plan - Growth Option Click here for performance in SEBI prescribed format.

An Open Ended income Scheme,

seeking to generate income

through investment in Central

Government Securities of various

maturities.

There is no assurance that the

investment objective of the

Scheme will be realized.

This Open Ended Income Scheme is suitable for investors who are seeking*

• Income over a long-term investment horizon

• Investment in Central government securities

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.