|

DSP Nifty Next 50 Index Fund An open ended scheme replicating / tracking NIFTY NEXT 50 Index |

|

|

Invests in 50 stocks beyond Nifty 50

The index aims to capture mega caps of tomorrow b catching them early in their growth cycle

Anil Ghelani

Total work experience of 21 years.

Managing this Scheme since

July 2019.

February 21, 2019

NIFTY Next 50 TRI

| Regular Plan | |

| Growth: | ₹ 11.0789 |

| Direct Plan | |

| Growth: | ₹ 11.1019 |

₹ 45 Cr

₹ 49 Cr

1.04

| Regular Plan : | 0.59% |

| Direct Plan : | 0.29% |

Nil

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Finance | 25.36% |

| ✔ SBI Life Insurance Company Limited | 4.82% |

| ✔ HDFC Life Insurance Company Limited | 4.15% |

| ✔ ICICI Lombard General Insurance Company Limited | 2.80% |

| Shriram Transport Finance Company Limited | 2.51% |

| Bajaj Holdings & Investment Limited | 2.47% |

| ICICI Prudential Life Insurance Company Limited | 2.41% |

| Power Finance Corporation Limited | 1.55% |

| HDFC Asset Management Company Limited | 1.42% |

| General Insurance Corporation of India | 1.00% |

| Indiabulls Housing Finance Limited | 0.91% |

| L&T Finance Holdings Limited | 0.78% |

| The New India Assurance Company Limited | 0.54% |

| Consumer Non Durables | 19.80% |

| ✔ Godrej Consumer Products Limited | 3.68% |

| ✔ Dabur India Limited | 3.43% |

| Colgate Palmolive (India) Limited | 2.71% |

| Marico Limited | 2.48% |

| United Spirits Limited | 2.45% |

| United Breweries Limited | 1.86% |

| Berger Paints (I) Limited | 1.68% |

| Procter & Gamble Hygiene and Health Care Limited | 1.51% |

| Pharmaceuticals | 11.63% |

| ✔ Divi's Laboratories Limited | 2.94% |

| Lupin Limited | 2.35% |

| Piramal Enterprises Limited | 2.33% |

| Aurobindo Pharma Limited | 1.74% |

| Biocon Limited | 1.43% |

| Cadila Healthcare Limited | 0.85% |

| Cement | 6.88% |

| ✔ Shree Cement Limited | 3.19% |

| Ambuja Cements Limited | 1.95% |

| ACC Limited | 1.74% |

| Transportation | 3.96% |

| Container Corporation of India Limited | 2.12% |

| Interglobe Aviation Limited | 1.84% |

| Banks | 3.68% |

| Bank of Baroda | 1.52% |

| Bandhan Bank Limited | 1.25% |

| Punjab National Bank | 0.91% |

| Auto Ancillaries | 3.66% |

| Motherson Sumi Systems Limited | 1.94% |

| Bosch Limited | 1.72% |

| Petroleum Products | 3.19% |

| ✔ Hindustan Petroleum Corporation Limited | 3.19% |

| Gas | 2.82% |

| ✔ Petronet LNG Limited | 2.82% |

| Chemicals | 2.80% |

| ✔ Pidilite Industries Limited | 2.80% |

| retailing | 2.78% |

| Avenue Supermarts Limited | 2.78% |

| Consumer Durables | 2.27% |

| Havells India Limited | 2.27% |

| Textile Products | 1.96% |

| Page Industries Limited | 1.96% |

| Industrial Capital Goods | 1.94% |

| Siemens Limited | 1.94% |

| Construction | 1.49% |

| DLF Limited | 1.49% |

| Auto | 1.45% |

| Ashok Leyland Limited | 1.45% |

| minerals/mining | 1.27% |

| NMDC Limited | 1.27% |

| Software | 0.96% |

| Oracle Financial Services Software Limited | 0.96% |

| Power | 0.71% |

| NHPC Limited | 0.71% |

| Non - Ferrous metals | 0.71% |

| Hindustan Zinc Limited | 0.71% |

| Telecom - Services | 0.38% |

| Vodafone Idea Limited | 0.38% |

| Total | 99.71% |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 0.65% |

| Total | 0.65% |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -0.36% |

| Total | -0.36% |

| GRAND TOTAL | 100.00% |

✔ Top 10 Holdings

Subject to SEBI (MF) Regulations and the applicable guidelines issued by SEBI, Scheme has entered into securities lending in accordance with the framework specified in this regard.

To invest in companies which are

constituents of NIFTY Next 50 Index

(underlying Index) in the same

proportion as in the index and

seeks to generate returns that are

commensurate (before fees and

expenses) with

the performance of the underlying

Index.

However, there is no assurance that the objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns.

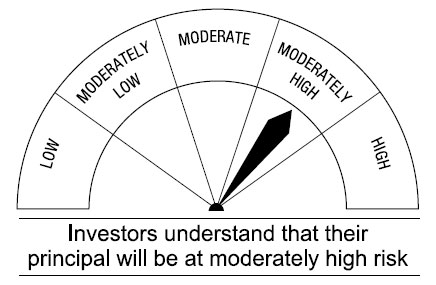

This open ended equity Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Returns that are commensurate with the performance of NIFTY Next 50 Index, subject to tracking error.

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.