|

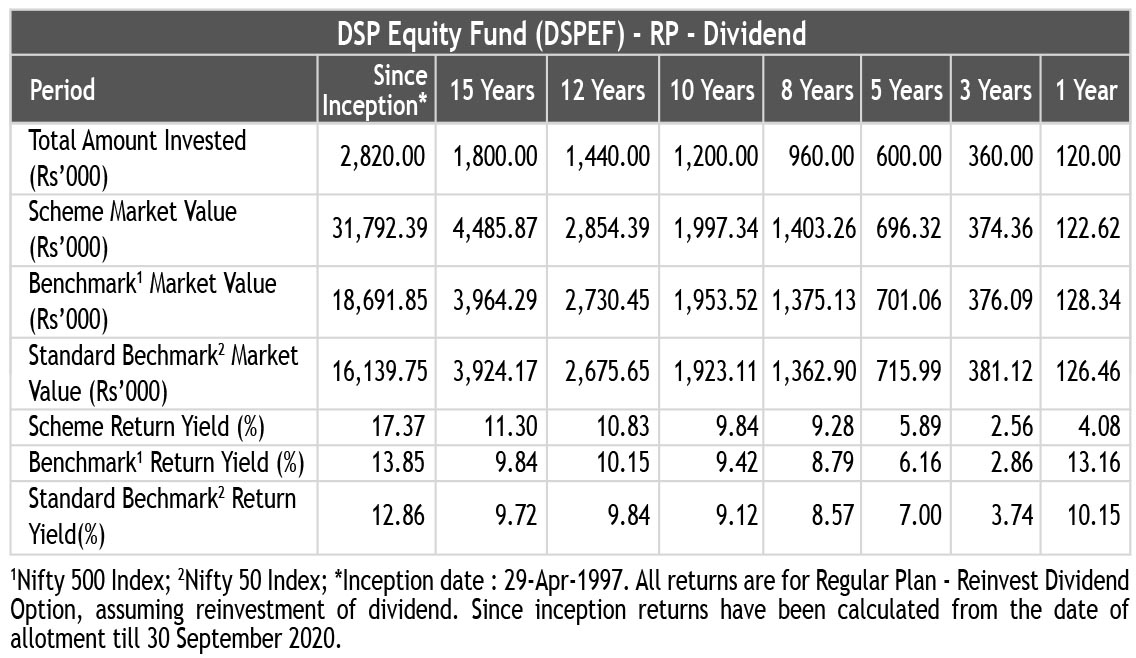

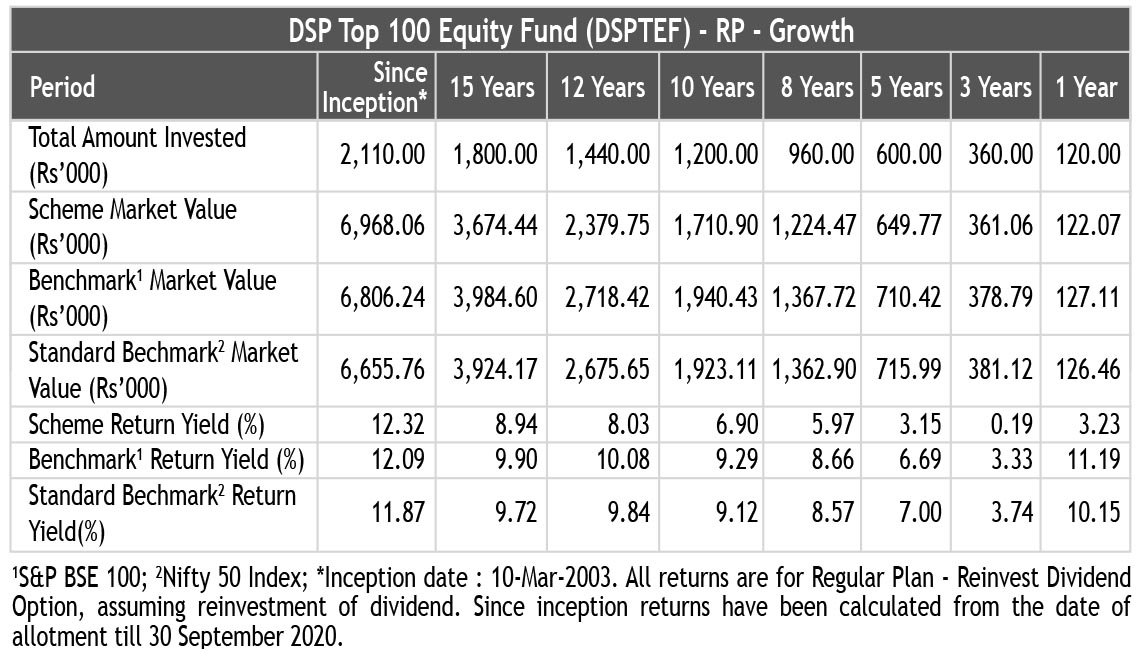

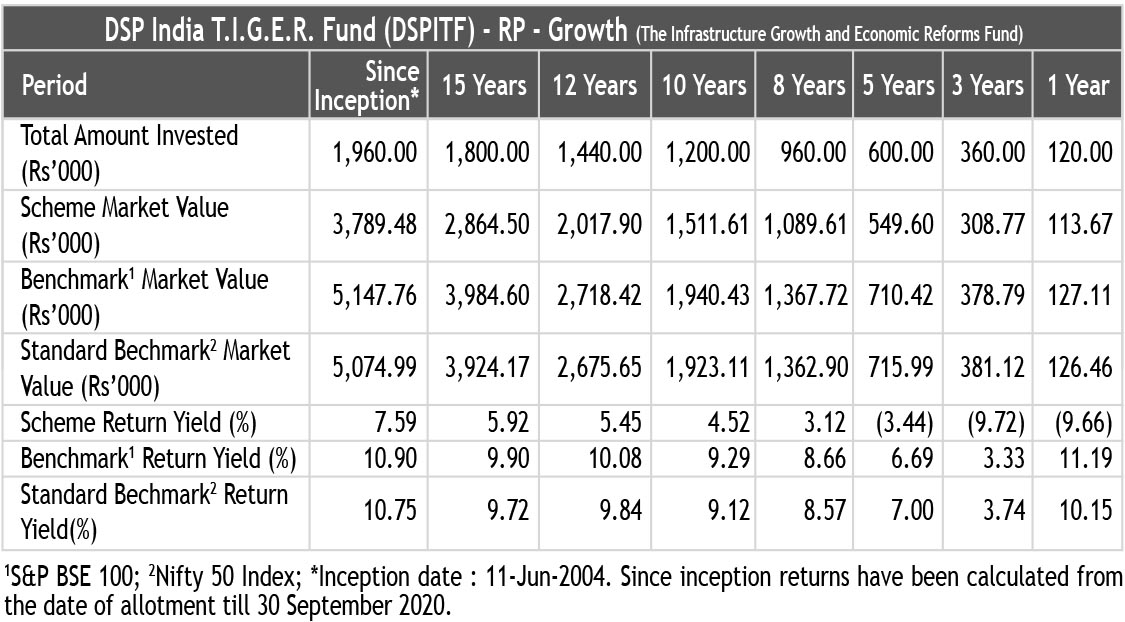

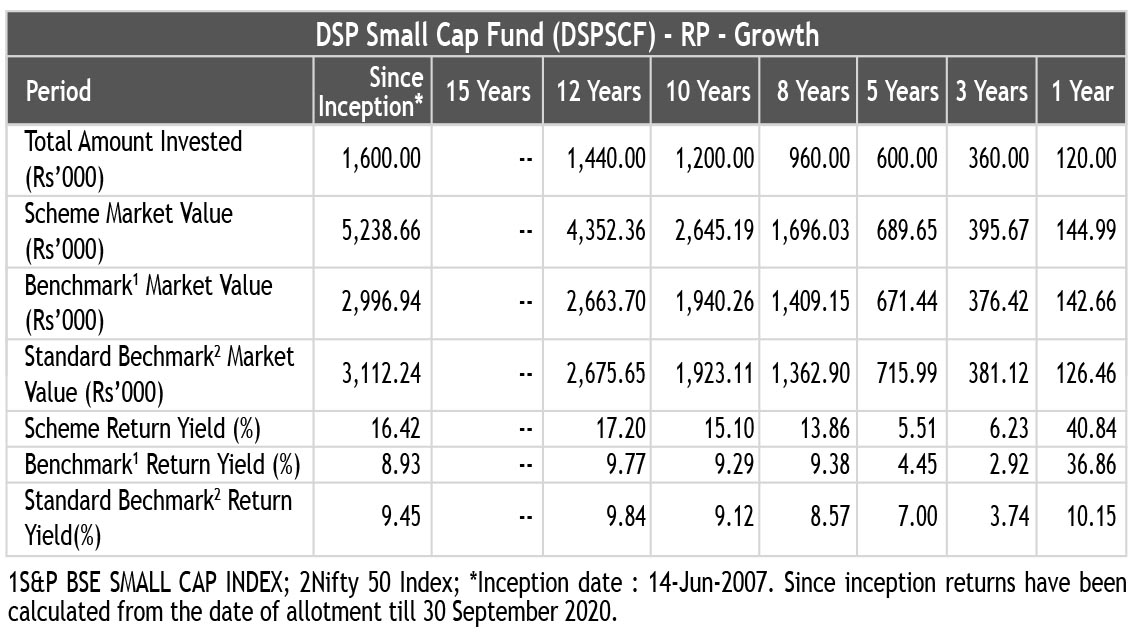

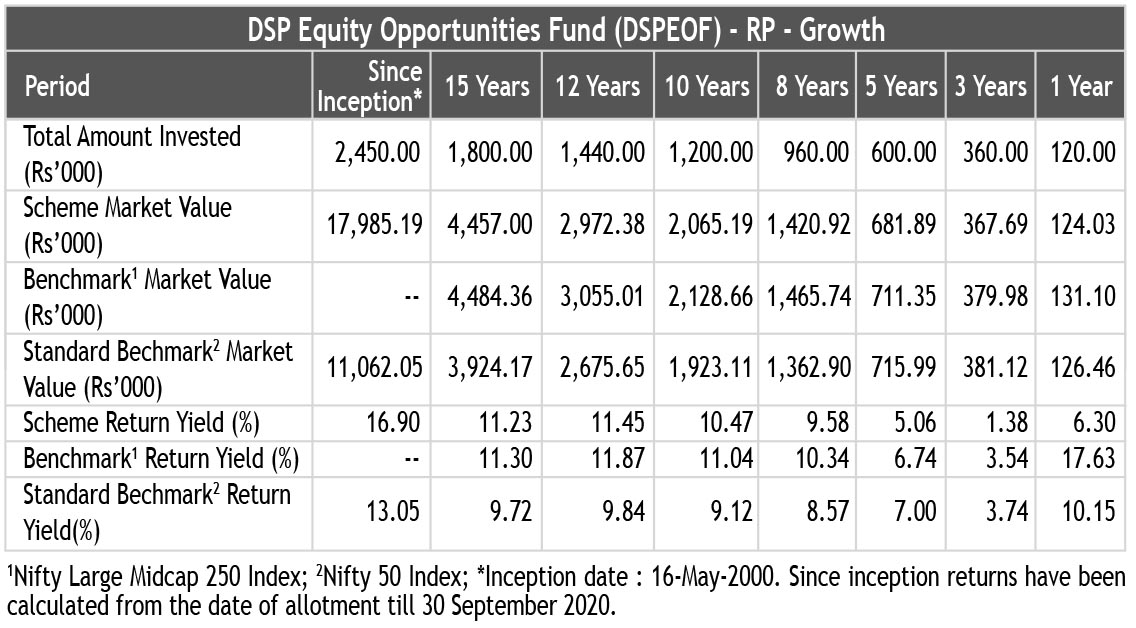

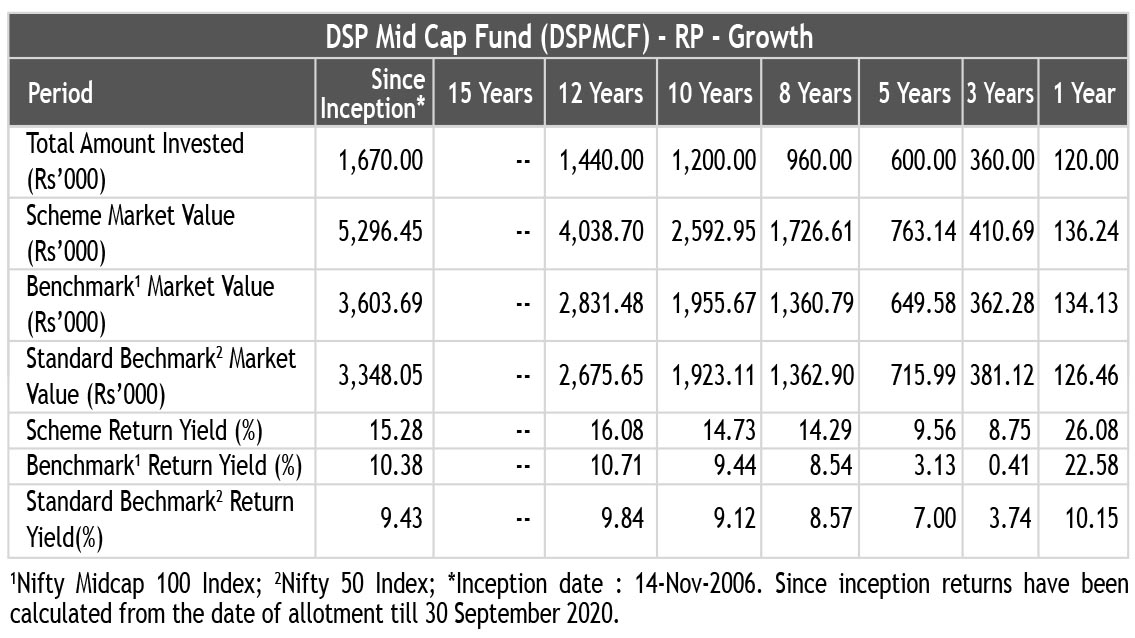

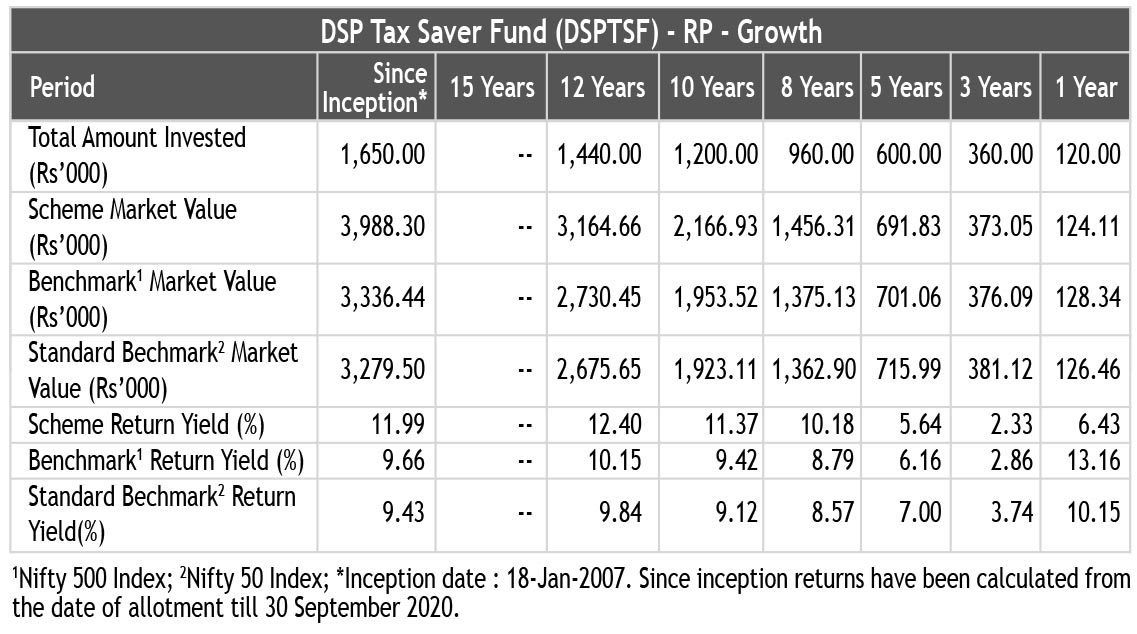

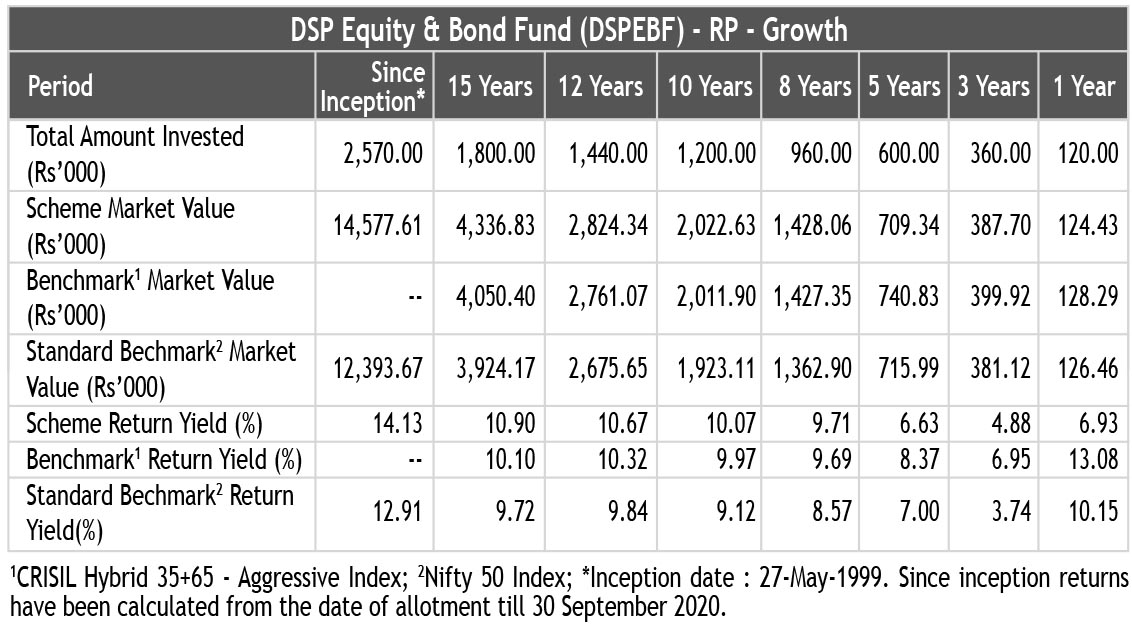

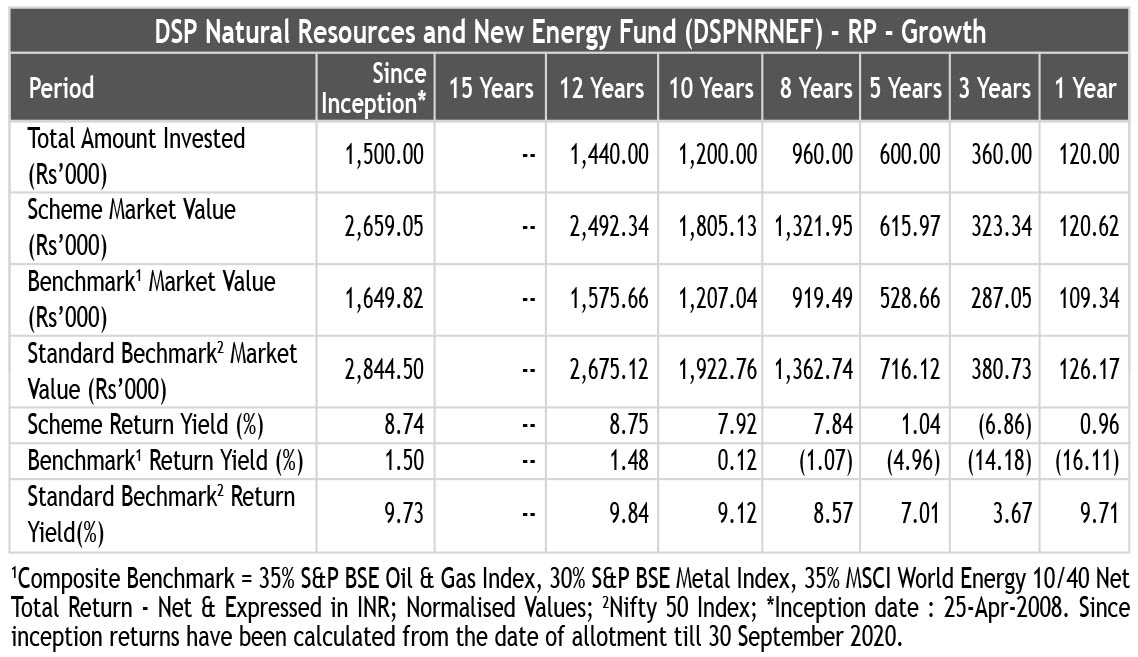

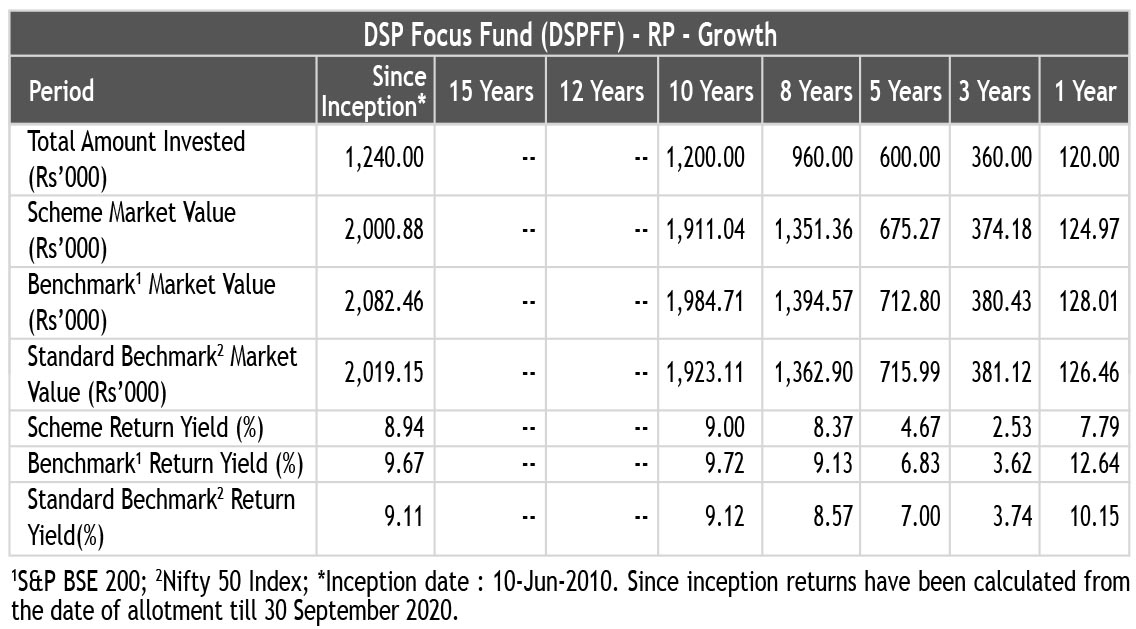

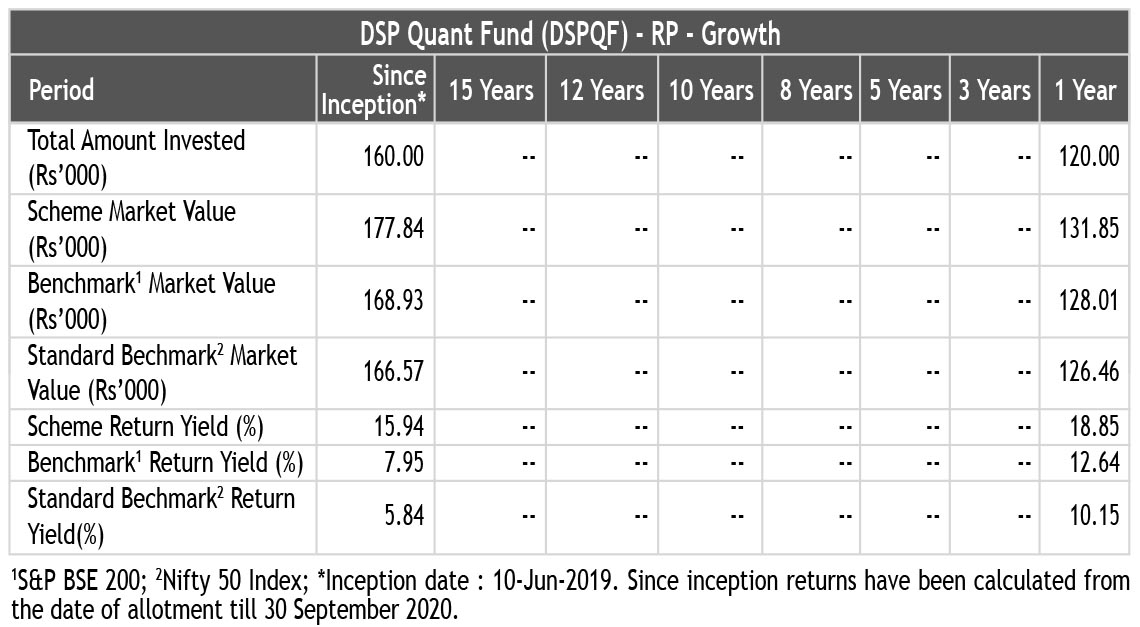

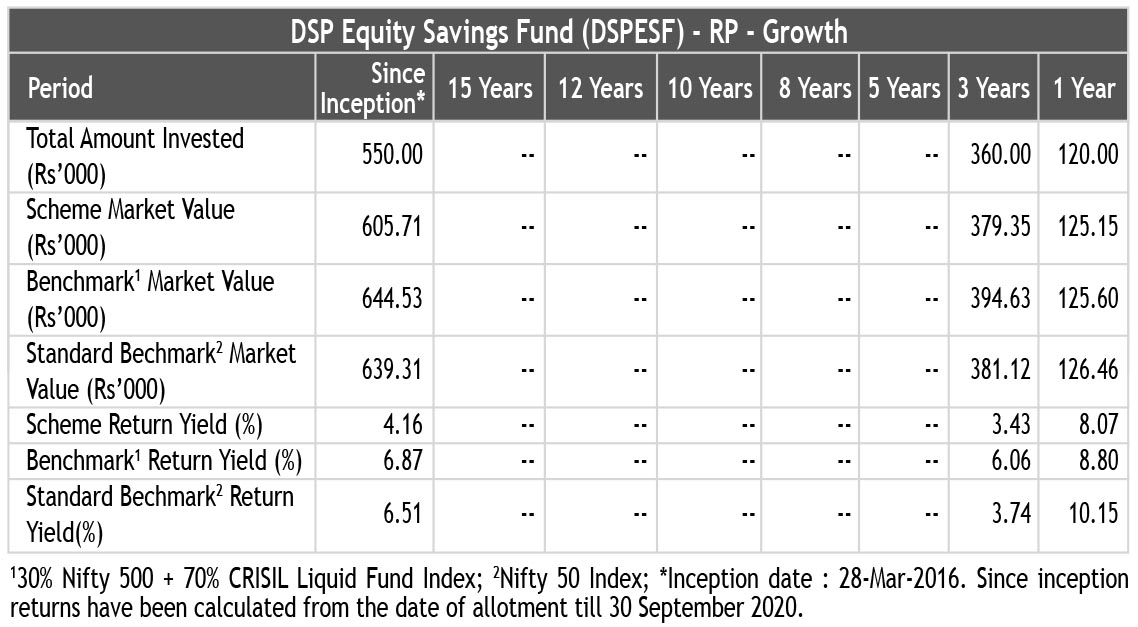

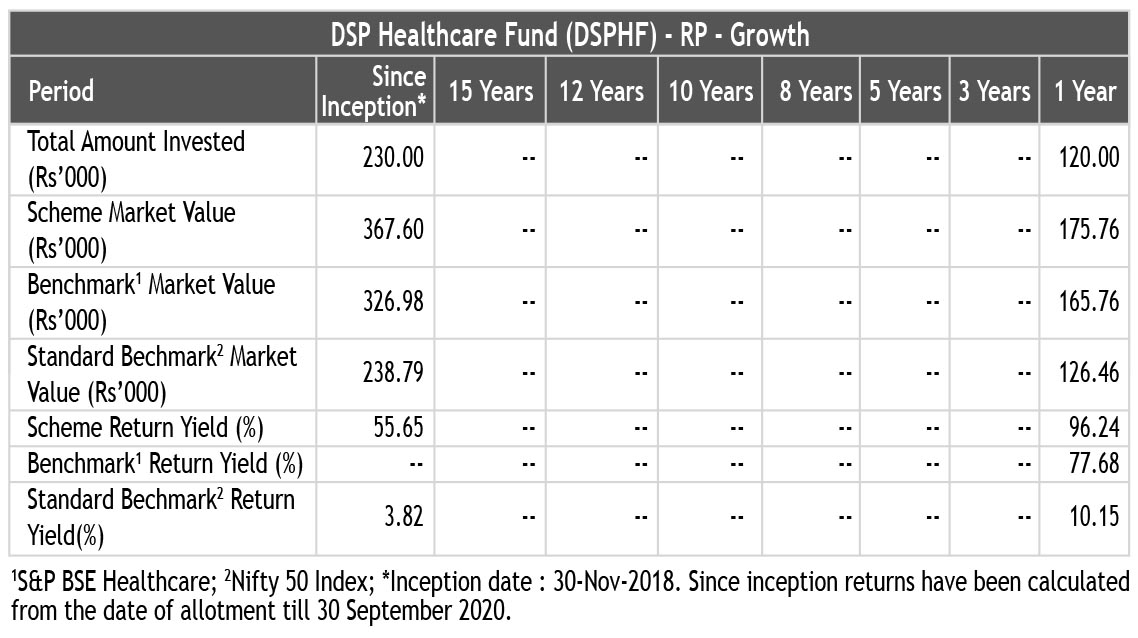

SIP Investment Performance of all Equity oriented schemes (as on SEPTEMBER 30,2020) |

|

|

DSP Mutual Fund offers flexible and convenient Systematic Investment Plan (SIP) facility. To illustrate the advantages of SIP investments, this is how your investments would have grown if

you had invested say ₹ 10,000/- systematically on the first Business Day of every month over a period of time.

RP - Regular Plan

Note:

(a) All returns are for Regular Plan - Growth Option. Except DSP Equity Fund.

(b) Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

The returns are calculated by XIRR approach assuming investment of ₹ 10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and

final value and a series of cash inflows and outflows with the correct allowance for the time impact of the transactions. Load is not taken into consideration for computation of performance.

DSPEBF is co-managed by Atul Bhole & Vikram Chopra . SIP performances for all the open ended Schemes managed by Atul Bhole are shown. Since the orientation & feature of DSPEBF is

different from all other schemes managed by Atul Bhole & Vikram Chopra, hence the SIP performances of other schemes managed by Atul Bhole & Vikram Chopra are not shown. Similarly,

DSPNRNEF is co-managed by Rohit Singhania & Jay Kothari. SIP performances are shown for all Schemes managed by Rohit Singhania. Since the orientation & feature of DSPNRNEF is different

from all other FOF schemes managed by Jay Kothari, the SIP performances of other FOF schemes managed by Jay Kothari are not shown.

For performance of all schemes in SEBI prescribed

format please refer Comparative Performance of all schemes.

Disclaimer: The above investment simulation is for illustrative purposes only and should not be construed as a promise on minimum returns and safeguard of capital. The AMC / Mutual Fund

is not guaranteeing or promising or forecasting any returns. SIP does not assure a profit or guarantee protection against a loss in a declining market.