|

DSP World Mining Fund An open ended fund of fund scheme investing in BlackRock Global Funds – World Mining Fund (BGF – WMF) |

|

|

- Fund of Fund scheme investing in units of BGF World Mining Fund.

- BGF World Mining Fund invests in the equity securities of mining and metals companies worldwide predominantly engaged in the production of base metals and industrial minerals.

Jay Kothari

Total work experience of 16 years.

Managing this scheme since March

2013.

Dec 29, 2009

Euromoney Global Mining

Constrained Weights Net

Total Return Index

| Regular Plan | |

| Growth: | ₹ 10.0987 |

| Direct Plan | |

| Growth: | ₹ 10.5276 |

₹ 47 Cr

₹ 47 Cr

| Regular Plan : | 2.45% |

| Direct Plan : | 1.69% |

| (Including TER of 1.01% of the underlying fund) | |

| The investors are bearing the recurring expenses of the Fund, in addition to the expenses of the underlying Fund | |

^Total TER is inclusive of the weighted average expenses levied by underlying schemes under regulation 52(6)(a) of SEBI (Mutual Funds) Regulations, 1996. | |

10 Yr 9 Mn

| Standard Deviation : | 24.94% |

| Beta : | 1.01 |

| Sharpe Ratio : | 0.24 |

Nil

Data As On September 30, 2020

| DSP World Mining Fund (FOF) as on August 31, 2020 | % to Net Assets |

| BlackRock Global Funds - World Mining Fund (Class I2 USD Shares)^^ | 97.18 |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 3.23 |

| Net Receivables/Payables | -0.41 |

| TOTAL | 100.00 |

| BlackRock Global Funds - World Mining Fund (Underlying Fund) as on August 31, 2020 | |

| Top 10 stocks | |

| Security | % to Net Assets |

| BHP GROUP PLC | 8.6 |

| NEWMONT CORPORATION | 8.4 |

| RIO TINTO PLC | 7.8 |

| VALE SA | 5.7 |

| BARRICK GOLD CORP | 4.9 |

| FREEPORT-MCMORAN INC | 4.8 |

| ANGLO AMERICAN PLC | 4.8 |

| WHEATON PRECIOUS METALS CORP | 4.8 |

| FRANCO NEVADA CORP | 4.0 |

| LUNDIN MINING CORPORATION | 2.5 |

| OTHERS | 42.7 |

| Cash | 1.0 |

| Total | 100 |

| Sector Allocation | |

| Gold | 34.7 |

| Diversified | 29.3 |

| Copper | 18.0 |

| Silver | 5.2 |

| Platinum Group Metals | 3.3 |

| Iron | 3.3 |

| Nickel | 2.8 |

| Industrial Minerals | 1.5 |

| Steel | 0.9 |

| Aluminium | 0.1 |

| Total | 99.02 |

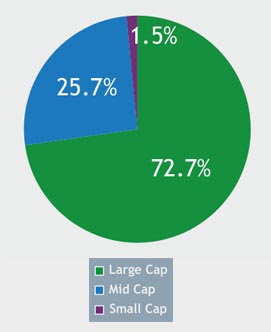

| Market Cap Allocation | |

| Large (>$10bn) | 72.7 |

| Mid | 25.7 |

| Small (<$1bn) | 1.5 |

| Total | 100.00 |

as on 30th Sept'20

^^Fund domiciled in Luxembourg

| Name of Instrument | % to Net Assets |

| OTHERS | |

| Foreign Securities | |

| BlackRock Global Funds - World Mining Fund (Class I2 USD Shares)^^ | 94.88 |

| Total | 94.88 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 5.24 |

| Total | 5.24 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -0.12 |

| Total | -0.12 |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

^^Fund domiciled in Luxembourg

| Growth of Rs. 1 L invested at inception: | 1.01 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 4.39 | 13.26 | 12.89 | 3.82 | |

| Outperformed Benchmark TRI (calendar year) | Euromoney Global Mining Constrained

Weights Net Total Return Index |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | -5.10 | -20.41 | -27.14 | -45.37 |

| Maximum (%) | 1.43 | 16.55 | 25.08 | 87.30 |

| Average (%) | -0.68 | -4.39 | -2.25 | 0.93 |

| % times negative returns | 58.76 | 78.01 | 60.73 | 51.11 |

| % of times returns are in excess of 7% | -- | 4.94 | 27.28 | 36.61 |

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

The primary investment objective

of the Scheme is to seek capital

appreciation by investing

predominantly in the units of

BlackRock Global Funds – World

Mining Fund (BGF-WMF). The

Scheme may, at the discretion

of the Investment Manager, also

invest in the units of other similar

overseas mutual fund schemes,

which may constitute a significant

part of its corpus. The Scheme

may also invest a certain portion

of its corpus in money market

securities and/or money market/

liquid schemes of DSP Mutual

Fund, in order to meet liquidity

requirements from time to time.

There is no assurance that the

investment objective of the

Scheme will be realised.

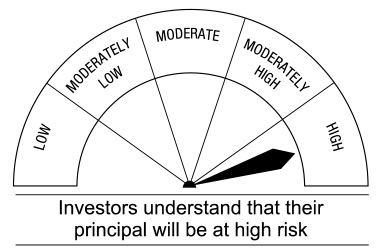

This Open Ended Scheme is suitable for investors who are seeking*

• Long-term capital growth

• Investment in units of overseas funds which invest primarily in equity and equity related securities

of mining companies

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.