|

DSP Tax Saver Fund An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

|

|

- The FM believes in buying fundamentally sound growth companies which are available at a cheaper valuation relative to its own history or its peers.

- The FM tries to capture growth at a reasonable price.

- The portfolio has a core and tactical element which takes care of the short and long term.

- Investments in the fund are locked in for 3 years.

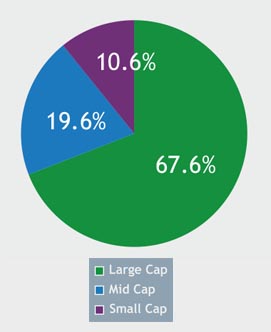

- Historically the fund has had a large cap bias but this has been a function of bottom up stock picking.

Rohit Singhania

Total work experience of 19 years.

Managing this Scheme since

July 2015

Jan 18, 2007

Nifty 500 (TRI)

| Regular Plan | |

| Growth: | ₹ 47.895 |

| Direct Plan | |

| Growth: | ₹ 50.842 |

₹ 6,178 Cr

₹ 6,233 Cr

1.33

| Standard Deviation : | 22.16% |

| Beta : | 1.00 |

| R-Squared : | 97.42% |

| Sharpe Ratio : | -0.05 |

| Regular Plan : | 1.86% |

| Direct Plan : | 0.92% |

ELSS

13 Yr 8 Mn

Not Applicable

Data As On September 30, 2020

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Banks | 23.10 |

| ✔ ICICI Bank Limited | 9.20 |

| ✔ HDFC Bank Limited | 9.19 |

| ✔ State Bank of India | 4.10 |

| Axis Bank Limited | 0.62 |

| Pharmaceuticals | 10.29 |

| ✔ Dr. Reddy's Laboratories Limited | 3.07 |

| IPCA Laboratories Limited | 1.52 |

| JB Chemicals & Pharmaceuticals Limited | 1.52 |

| Alembic Pharmaceuticals Limited | 1.52 |

| Cipla Limited | 1.47 |

| Sun Pharmaceutical Industries Limited | 1.19 |

| Finance | 9.82 |

| ✔ Housing Development Finance Corporation Limited | 2.50 |

| ✔ Manappuram Finance Limited | 2.13 |

| SBI Life Insurance Company Limited | 1.06 |

| HDFC Asset Management Company Limited | 1.05 |

| Cholamandalam Investment and Finance Company Limited | 0.98 |

| HDFC Life Insurance Company Limited | 0.80 |

| ICICI Lombard General Insurance Company Limited | 0.74 |

| Equitas Holdings Limited | 0.55 |

| Software | 8.00 |

| ✔ Infosys Limited | 6.73 |

| MphasiS Limited | 1.27 |

| Telecom - Services | 6.85 |

| ✔ Bharti Airtel Limited | 6.85 |

| Petroleum Products | 6.08 |

| ✔ Reliance Industries Limited | 3.35 |

| Hindustan Petroleum Corporation Limited | 1.67 |

| Bharat Petroleum Corporation Limited | 0.84 |

| Reliance Industries Limited - Partly Paid Shares | 0.21 |

| Consumer Non Durables | 5.97 |

| Hindustan Unilever Limited | 1.54 |

| Britannia Industries Limited | 1.50 |

| Emami Limited | 1.40 |

| Colgate Palmolive (India) Limited | 0.70 |

| Dabur India Limited | 0.55 |

| LT Foods Limited | 0.28 |

| Consumer Durables | 4.27 |

| Crompton Greaves Consumer Electricals Limited | 1.92 |

| Voltas Limited | 1.19 |

| Sheela Foam Limited | 1.16 |

| Cement | 4.09 |

| ✔ UltraTech Cement Limited | 2.14 |

| ACC Limited | 1.95 |

| Chemicals | 2.95 |

| Atul Limited | 1.97 |

| GHCL Limited | 0.98 |

| Power | 2.38 |

| NTPC Limited | 1.85 |

| CESC Limited | 0.53 |

| Fertilisers | 1.61 |

| Coromandel International Limited | 0.95 |

| Chambal Fertilizers & Chemicals Limited | 0.66 |

| Non - Ferrous Metals | 1.46 |

| Hindalco Industries Limited | 1.46 |

| Gas | 1.22 |

| Gujarat State Petronet Limited | 1.22 |

| Auto | 1.17 |

| Hero MotoCorp Limited | 1.17 |

| Construction Project | 1.11 |

| Larsen & Toubro Limited | 1.11 |

| Industrial Products | 1.09 |

| KEI Industries Limited | 0.59 |

| Finolex Cables Limited | 0.50 |

| Industrial Capital Goods | 1.08 |

| Bharat Electronics Limited | 1.08 |

| Textile Products | 1.08 |

| Welspun India Limited | 1.08 |

| Construction | 1.05 |

| KNR Constructions Limited | 0.67 |

| Ahluwalia Contracts (India) Limited | 0.38 |

| Transportation | 0.93 |

| Container Corporation of India Limited | 0.93 |

| Textiles - Cotton | 0.76 |

| Vardhman Textiles Limited | 0.76 |

| Auto Ancillaries | 0.60 |

| Varroc Engineering Limited | 0.60 |

| Hotels, Resorts And Other Recreational Activities | 0.53 |

| Westlife Development Ltd | 0.53 |

| Telecom - Equipment & Accessories | 0.32 |

| Sterlite Technologies Limited | 0.32 |

| Total | 97.80 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 1.83 |

| Total | 1.83 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | 0.37 |

| Total | 0.37 |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

✔ Top Ten Holdings

| Growth of Rs. 1 L invested at inception: | 4.79 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 11.37 | 5.64 | 2.33 | 11.99 | |

| Outperformed Benchmark TRI (calendar year) | NIFTY 500 TRI

54% |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | 7.9 | -0.5 | -6.0 | -59.0 |

| Maximum (%) | 21.0 | 24.6 | 32.1 | 120.7 |

| Average (%) | 14.0 | 14.4 | 14.2 | 14.8 |

| % times negative returns | -- | 0.2 | 4.4 | 25.6 |

| % of times returns are in excess of 7% | 100.0 | 84.9 | 81.2 | 58.9 |

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Banks |

| Kotak Mahindra Bank Limited |

| Minerals/Mining |

| Coal India Limited |

| Consumer Non Durables |

| Asian Paints Limited |

| Pesticides |

| PI Industries Limited |

| Industrial Products |

| Srikalahasthi Pipes Limited |

| New Position Bought |

| Fertilisers |

| Chambal Fertilizers & Chemicals Limited |

| Positions Increased |

| Petroleum Products |

| Hindustan Petroleum Corporation Limited |

| Software |

| MphasiS Limited |

| Infosys Limited |

| Pharmaceuticals |

| Dr. Reddy's Laboratories Limited |

| Sun Pharmaceutical Industries Limited |

| Cipla Limited |

| Consumer Non Durables |

| Colgate Palmolive (India) Limited |

| Britannia Industries Limited |

| Industrial Products |

| KEI Industries Limited |

| Banks |

| State Bank of India |

| ICICI Bank Limited |

| HDFC Bank Limited |

| Gas |

| Gujarat State Petronet Limited |

| Positions Decreased |

| Auto |

| Hero MotoCorp Limited |

| Power |

| CESC Limited |

| Fertilisers |

| Coromandel International Limited |

| Consumer Durables |

| Voltas Limited |

| Chemicals |

| Atul Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Finance |

| Cholamandalam Investment and Finance Company Limited |

| Housing Development Finance Corporation Limited |

| Petroleum Products |

| Reliance Industries Limited |

| Non - Ferrous Metals |

| Hindalco Industries Limited |

| Banks |

| Axis Bank Limited |

| Pharmaceuticals |

| JB Chemicals & Pharmaceuticals Limited |

Rebalances below 0.05 % are not considered.

An Open ended equity linked savings scheme,

whose primary investment objective is to

seek to generate medium to longterm capital

appreciation from a diversified portfolio that

is substantially constituted of equity and

equity related securities of corporates, and

to enable investors avail of a deduction from

total income, as permitted under the Income

Tax Act,1961 from time to time.

There is no assurance that the investment

objective of the Scheme will be realized.

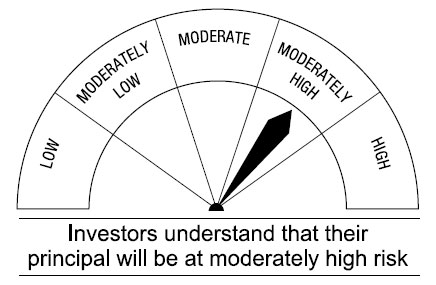

This Open Ended Equity Linked Saving Scheme is suitable for investors who are seeking*

• Long-term capital growth with a three-year lock-in

• Investment in equity and equity-related securities to form a diversified portfolio

* Investors should consult their financial/tax advisors if in doubt whether the product is suitable for them.