|

DSP Focus Fund An open ended equity scheme investing in maximum 30 stocks. The Scheme shall focus on multi cap stocks. |

|

|

Vinit Sambre

Total work experience of 21 years

Managing the Scheme since June

2020

Jay Kothari (Dedicated Fund

Manager for overseas investments)

Total work experience of 16 years.

Managing this Scheme since March

2013

Jun 10, 2010

S&P BSE 200 (TRI)

| Regular Plan | |

| Growth: | ₹ 23.264 |

| Direct Plan | |

| Growth: | ₹ 24.691 |

₹ 1,856 Cr

₹ 1,832 Cr

0.48

| Standard Deviation : | 23.91% |

| Beta : | 1.10 |

| R-Squared : | 95.82% |

| Sharpe Ratio : | -0.06 |

| Regular Plan : | 2.15% |

| Direct Plan : | 1.09% |

Focused

10 Yr 3 Mn

Holding period <12 months: 1%

Holding period >=12 months: Nil

Data As On September 30, 2020

| Name of Instrument | % to Net Assets |

| EQUITY & EQUITY RELATED | |

| Listed / awaiting listing on the stock exchanges | |

| Banks | 15.50 |

| ✔ HDFC Bank Limited | 9.18 |

| ✔ ICICI Bank Limited | 6.32 |

| Consumer Durables | 11.84 |

| ✔ Havells India Limited | 3.65 |

| Whirlpool of India Limited | 3.30 |

| Titan Company Limited | 2.46 |

| Sheela Foam Limited | 2.42 |

| Software | 11.77 |

| ✔ Infosys Limited | 6.12 |

| ✔ Tata Consultancy Services Limited | 4.65 |

| Tech Mahindra Limited | 1.00 |

| Consumer Non Durables | 9.22 |

| Colgate Palmolive (India) Limited | 3.33 |

| Emami Limited | 2.57 |

| Dabur India Limited | 1.99 |

| Godrej Consumer Products Limited | 1.34 |

| Finance | 8.76 |

| SBI Life Insurance Company Limited | 2.82 |

| HDFC Life Insurance Company Limited | 2.26 |

| ICICI Lombard General Insurance Company Limited | 2.14 |

| Bajaj Finance Limited | 1.54 |

| Cement | 8.51 |

| ✔ UltraTech Cement Limited | 4.82 |

| ✔ Shree Cement Limited | 3.68 |

| Auto | 7.39 |

| ✔ Maruti Suzuki India Limited | 4.10 |

| Eicher Motors Limited | 3.29 |

| Fertilisers | 7.30 |

| ✔ Coromandel International Limited | 7.30 |

| Pharmaceuticals | 7.30 |

| ✔ Cipla Limited | 3.71 |

| Dr. Reddy's Laboratories Limited | 3.58 |

| Telecom - Services | 2.67 |

| Bharti Airtel Limited | 2.67 |

| Industrial Products | 2.29 |

| AIA Engineering Limited | 2.29 |

| Non - Ferrous Metals | 1.30 |

| Hindalco Industries Limited | 1.30 |

| Construction | 1.10 |

| Ahluwalia Contracts (India) Limited | 1.10 |

| Total | 94.93 |

| MONEY MARKET INSTRUMENTS | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 5.39 |

| Total | 5.39 |

| Cash & Cash Equivalent | |

| Net Receivables/Payables | -0.32 |

| Total | -0.32 |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

✔ Top Ten Holdings

DSP Focus Fund erstwhile known as DSP Focus 25 Fund

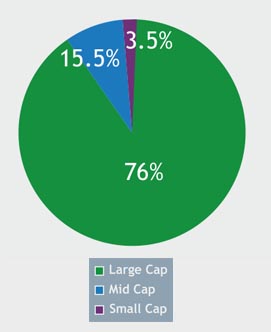

Classification of % of holdings based on Market Capitalisation: Large-Cap 75.95%, Mid Cap 15.46%, Small-Cap

3.52%.

Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms of

full market capitalization Small Cap: 251st company onwards in terms of full market capitalization

| Growth of Rs. 1 L invested at inception: | 2.33 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 9.00 | 4.67 | 2.53 | 8.94 | |

| Outperformed Benchmark TRI (calendar year) |

S&P BSE 200 TRI 50% |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | 7.1 | -1.9 | -7.4 | -29.7 |

| Maximum (%) | 8.3 | 22.1 | 28.4 | 71.8 |

| Average (%) | 7.8 | 12.5 | 11.8 | 9.9 |

| % times negative returns | -- | 0.8 | 11.1 | 30.7 |

| % of times returns are in excess of 7% | 100.0 | 88.9 | 74.1 | 48.2 |

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Petroleum Products |

| Reliance Industries Limited |

| New Position Bought |

| Consumer Non Durables |

| Godrej Consumer Products Limited |

| Positions Increased |

| Industrial Products |

| AIA Engineering Limited |

| Software |

| Tata Consultancy Services Limited |

| Infosys Limited |

| Pharmaceuticals |

| Cipla Limited |

| Consumer Non Durables |

| Colgate Palmolive (India) Limited |

| Positions Decreased |

| Telecom - Services |

| Bharti Airtel Limited |

Rebalances below 0.05 % are not considered.

The primary investment objective of

the Scheme is to generate long-term

capital growth from a portfolio of equity

and equity-related securities including

equity derivatives. The portfolio will

consist of multi cap companies by market

capitalisation. The Scheme will hold

equity and equity-related securities

including equity derivatives, of upto 30

companies. The Scheme may also invest

in debt and money market securities,

for defensive considerations and/or for

managing liquidity requirements.

There is no assurance that the

investment objective of the Scheme

will be realized.

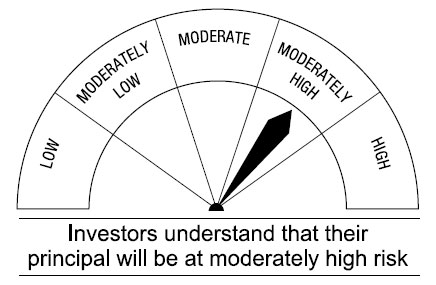

This Open Ended Equity Scheme is suitable for investors who are seeking*

• Long-term capital growth with exposure limited to a maximum of 30 stocks from a multi cap investment universe

• Investment in equity and equity-related securities to form a concentrated portfolio

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.