|

DSP Equity & Bond Fund An open ended hybrid scheme investing predominantly in equity and equity related instruments |

|

|

- Aggressive Hybrid scheme investing predominantly in equity and equity related instruments.

- Portfolio is a combination of well diversified market cap and sector agnostic equity portfolio and high quality fixed income portfolio.

Atul Bhole (Equity portion)

Total work experience of 13 years.

Managing this Scheme since

June 2016.

Vikram Chopra (Debt portion)

Total work experience of 18 years.

Managing this Scheme since

July 2016.

May 27, 1999

CRISIL Hybrid 35+65-Aggressive Index

| Regular Plan | |

| Growth: | ₹ 160.577 |

| Direct Plan | |

| Growth: | ₹ 171.813 |

₹ 5,502 Cr

₹ 5,587 Cr

1.70

| Standard Deviation : | 17.22% |

| Beta : | 1.18 |

| R-Squared : | 91.04% |

| Sharpe Ratio : | 0.06 |

| Regular Plan : | 1.92% |

| Direct Plan : | 0.87% |

5.11 years

3.98 years

6.50%

4.13 years

Aggressive Hybrid

21 Yr 4 Mn

Holding Period : < 12 months: 1%~

Holding Period :>= 12 months: Nil

~If the units redeemed or switched

out are upto 10% of the units (the

limit) purchased or switched: Nil.

Data As On September 30, 2020

| Name of Instrument | % to Net Assets | |

| EQUITY & EQUITY RELATED | ||

| Listed / awaiting listing on the stock exchanges | ||

| Banks | 13.88 | |

| ✔ HDFC Bank Limited | 5.21 | |

| ✔ ICICI Bank Limited | 4.72 | |

| Kotak Mahindra Bank Limited | 2.35 | |

| Axis Bank Limited | 1.60 | |

| Finance | 12.20 | |

| ✔ Bajaj Finance Limited | 3.23 | |

| ✔ Muthoot Finance Limited | 2.61 | |

| Bajaj Finserv Limited | 1.21 | |

| ICICI Lombard General Insurance Company Limited | 1.16 | |

| Housing Development Finance Corporation Limited | 1.00 | |

| HDFC Life Insurance Company Limited | 0.94 | |

| HDFC Asset Management Company Limited | 0.84 | |

| ICICI Prudential Life Insurance Company Limited | 0.76 | |

| Equitas Holdings Limited | 0.35 | |

| Satin Creditcare Network Limited | 0.07 | |

| Satin Creditcare Network Limited - Partly Paid Shares | 0.02 | |

| Pharmaceuticals | 5.10 | |

| Dr. Reddy's Laboratories Limited | 2.20 | |

| Alkem Laboratories Limited | 1.23 | |

| IPCA Laboratories Limited | 0.99 | |

| Divi's Laboratories Limited | 0.68 | |

| Software | 4.97 | |

| ✔ Tata Consultancy Services Limited | 2.70 | |

| Infosys Limited | 2.27 | |

| Consumer Durables | 4.58 | |

| Crompton Greaves Consumer Electricals Limited | 1.00 | |

| Relaxo Footwears Limited | 0.97 | |

| Voltas Limited | 0.90 | |

| Havells India Limited | 0.69 | |

| V-Guard Industries Limited | 0.62 | |

| Century Plyboards (India) Limited | 0.40 | |

| Cement | 4.47 | |

| ✔ UltraTech Cement Limited | 2.76 | |

| Shree Cement Limited | 1.10 | |

| The Ramco Cements Limited | 0.61 | |

| Retailing | 4.07 | |

| Avenue Supermarts Limited | 1.85 | |

| V-Mart Retail Limited | 1.62 | |

| Trent Limited | 0.60 | |

| Consumer Non Durables | 4.04 | |

| Britannia Industries Limited | 1.95 | |

| Asian Paints Limited | 1.10 | |

| Emami Limited | 1.00 | |

| Gas | 3.73 | |

| Indraprastha Gas Limited | 1.49 | |

| Gujarat Gas Limited | 1.22 | |

| Petronet LNG Limited | 1.03 | |

| Chemicals | 3.49 | |

| Atul Limited | 1.64 | |

| Aarti Industries Limited | 1.24 | |

| Solar Industries India Limited | 0.62 | |

| Construction | 3.00 | |

| Godrej Properties Limited | 1.32 | |

| KNR Constructions Limited | 0.89 | |

| Ahluwalia Contracts (India) Limited | 0.79 | |

| Telecom - Services | 2.86 | |

| ✔ Bharti Airtel Limited | 2.86 | |

| Auto Ancillaries | 1.62 | |

| Minda Industries Limited | 0.93 | |

| Balkrishna Industries Limited | 0.69 | |

| Fertilisers | 1.42 | |

| Coromandel International Limited | 1.42 | |

| Industrial Products | 1.39 | |

| Essel Propack Limited | 0.82 | |

| KEI Industries Limited | 0.56 | |

| Pesticides | 1.27 | |

| PI Industries Limited | 1.27 | |

| Power | 0.74 | |

| Tata Power Company Limited | 0.74 | |

| Auto | 0.52 | |

| Maruti Suzuki India Limited | 0.52 | |

| Textiles - Synthetic | 0.43 | |

| Ganesha Ecosphere Limited | 0.43 | |

| Industrial Capital Goods | 0.37 | |

| Siemens Limited | 0.37 | |

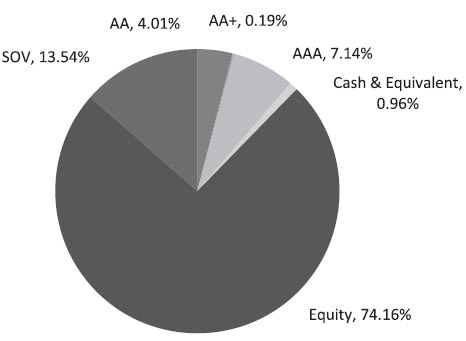

| Total | 74.16 | |

| Unlisted | ||

| Software | * | |

| SIP Technologies & Export Limited** | * | |

| Total | * | |

| Name of Instrument | Rating | to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| ✔ Green Infra Wind Energy Limited | CRISIL AA | 2.71 |

| National Housing Bank | CRISIL AAA | 1.42 |

| REC Limited | CARE AAA | 1.03 |

| REC Limited | CRISIL AAA | 0.77 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 0.77 |

| Indian Oil Corporation Limited | CRISIL AAA | 0.67 |

| Housing Development Finance Corporation Limited | CRISIL AAA | 0.60 |

| Power Finance Corporation Limited | CARE AAA | 0.57 |

| State Bank of India | ICRA AAA | 0.36 |

| Hindustan Petroleum Corporation Limited | IND AAA | 0.30 |

| Bank of Baroda AT-1 Basel-III | CARE AA | 0.22 |

| NTPC Limited | CARE AAA | 0.19 |

| Bank of Baroda AT-1 Basel-III | IND AA+ | 0.19 |

| Power Grid Corporation of India Limited | CRISIL AAA | 0.10 |

| Power Grid Corporation of India Limited | ICRA AAA | 0.10 |

| GAIL (India) Limited | CARE AAA | 0.10 |

| NHPC Limited | CARE AAA | 0.10 |

| Hindustan Petroleum Corporation Limited | CRISIL AAA | 0.06 |

| Total | 10.26 | |

| Unlisted | ||

| KKR India Financial Services Private Limited | CRISIL AA | 1.08 |

| Total | 1.08 | |

| Government Securities (Central/State) | ||

| ✔ 5.77% GOI 03-08-2030 | SOV | 5.41 |

| ✔ 7.59% GOI 11-01-2026 | SOV | 2.60 |

| 7.27% GOI 08-04-2026 | SOV | 1.98 |

| 7.32% GOI 28-01-2024 | SOV | 1.38 |

| 7.26% GOI 14-01-2029 | SOV | 0.99 |

| 6.79% GOI 15-05-2027 | SOV | 0.49 |

| 7.37% GOI 16-04-2023 | SOV | 0.40 |

| 6.79% GOI 26-12-2029 | SOV | 0.29 |

| Total | 13.54 | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 2.27 | |

| Total | 2.27 | |

| Cash & Cash Equivalent | ||

| Net Receivables/Payables | -1.31 | |

| Total | -1.31 | |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

✔Top Ten Holdings

*Less than 0.01%

** Non Traded / Thinly Traded and illiquid securities in accordance with SEBI Regulations

DSP Equity & Bond Fund erstwhile known as DSP Balanced Fund

@@Computed on the invested amount for debt portfolio

Notes:

1.Pursuant to SEBI circular SEBI/HO/IMD/DF4/CIR/P/2019/102 dated September 24, 2019 read with circular no.

SEBI/HO/IMD/DF4/CIR/P/2019/41 dated March 22, 2019. Below are the details of the securities in case of which

issuer has defaulted beyond its maturity date

| Security | ISIN | value of the security considered under net receivables (i.e. value recognized in NAV in absolute terms and as % to NAV) (Rs.in lakhs) | total amount (including principal and interest) that is due to the scheme on that investment (Rs.in lakhs) | |

| 0% IL&FS Transportation Networks Limited Ncd Series A 23032019 | INE975G08140 | 0.00 | 0.00 | 5,965.03 |

| Growth of Rs. 1 L invested at inception: | 16.19 L |

| SIP Returns(In %) | ||||

| 10 yr | 5 yr | 3 yr | SI* | |

| 10.07 | 6.63 | 4.88 | 14.13 | |

| Outperformed Benchmark TRI (calendar year) | CRISIL Hybrid 35+65 -

Aggressive Index 78% |

| 10 yr | 5 yr | 3 yr | 1 yr | |

| Minimum (%) | 7.6 | 3.0 | -11.9 | -39.9 |

| Maximum (%) | 23.5 | 42.5 | 51.0 | 89.3 |

| Average (%) | 15.8 | 16.9 | 16.3 | 15.9 |

| % times negative returns | -- | -- | 6.9 | 23.7 |

| % of times returns are in excess of 7% | 100.0 | 95.3 | 79.2 | 60.7 |

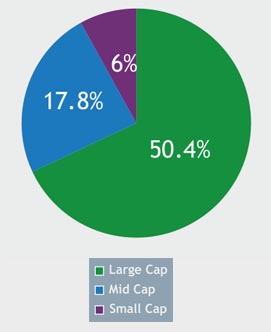

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

| Positions Exited |

| Industrial Products |

| SKF India Limited |

| New Position Bought |

| Software |

| Infosys Limited |

| Gas |

| Gujarat Gas Limited |

| Finance |

| HDFC Asset Management Company Limited |

| Positions Increased |

| Pesticides |

| PI Industries Limited |

| Gas |

| Indraprastha Gas Limited |

| Banks |

| Kotak Mahindra Bank Limited |

| Software |

| Tata Consultancy Services Limited |

| Finance |

| Muthoot Finance Limited |

| Retailing |

| Avenue Supermarts Limited |

| Cement |

| UltraTech Cement Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Industrial Products |

| KEI Industries Limited |

| Positions Decreased |

| Fertilisers |

| Coromandel International Limited |

| Construction |

| Godrej Properties Limited |

| Pharmaceuticals |

| Alkem Laboratories Limited |

| Consumer Non Durables |

| Asian Paints Limited |

| Cement |

| Shree Cement Limited |

| Auto Ancillaries |

| Balkrishna Industries Limited |

| Auto |

| Bajaj Auto Limited |

| Retailing |

| Trent Limited |

| Banks |

| HDFC Bank Limited |

| ICICI Bank Limited |

| Axis Bank Limited |

| Finance |

| Bajaj Finance Limited |

| Bajaj Finserv Limited |

| Consumer Durables |

| Voltas Limited |

| Titan Company Limited |

Rebalances below 0.05 % are not considered.

The primary investment objective

of the Scheme, seeking to generate

long term capital appreciation and

current income from a portfolio

constituted of equity and equity

related securities as well as fixed

income securities (debt and money

market securities).

There is no assurance that the

investment objective of the

Scheme will be realized.

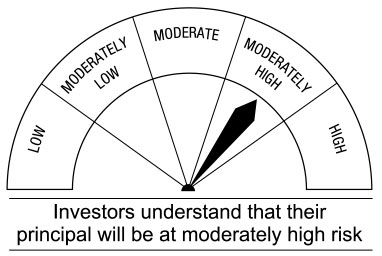

This Open Ended aggressive hybrid scheme is suitable for investors who are seeking*

• Capital growth and income over a long-term investment horizon

• Investment primarily in equity/equity-related securities, with balance exposure in money market

and debt Securities

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.