|

DSP Credit Risk Fund An open ended debt scheme predominantly investing in AA and below rated corporate bonds (excluding AA+ rated corporate bonds). |

|

|

Short duration with credit risk (max 35% in AAA)

Suitable for investors seeking credit exposure, potential to earn higher, tax-efficient returns than traditional time deposit of >=3 years

Saurabh Bhatia

Total work experience of 19

years.

Managing this Scheme

since March 2019.

Laukik Bagwe

Total work experience of 18

years.

Managing this Scheme

since July 2016.

Credit Risk

May 13, 2003

CRISIL Short Term Credit Risk Index

| Regular Plan | |

| Growth: | ₹ 29.6363 |

| Direct Plan | |

| Growth: | ₹ 31.1382 |

₹ 328 Cr

₹ 333 Cr

| Regular Plan : | 1.58% |

| Direct Plan : | 0.78% |

0.50 years

> 3years +

| Modified Duration | 0.35 years |

| Yield To Maturity | 6.24% |

| Portfolio Macaulay Duration | 0.38 years |

Holding Period :

< 12 months: 1%~; >= 12 months: Nil

~If the units redeemed or switched

out are upto 10% of the units (the

limit) purchased or switched: Nil.

Data As On September 30, 2020

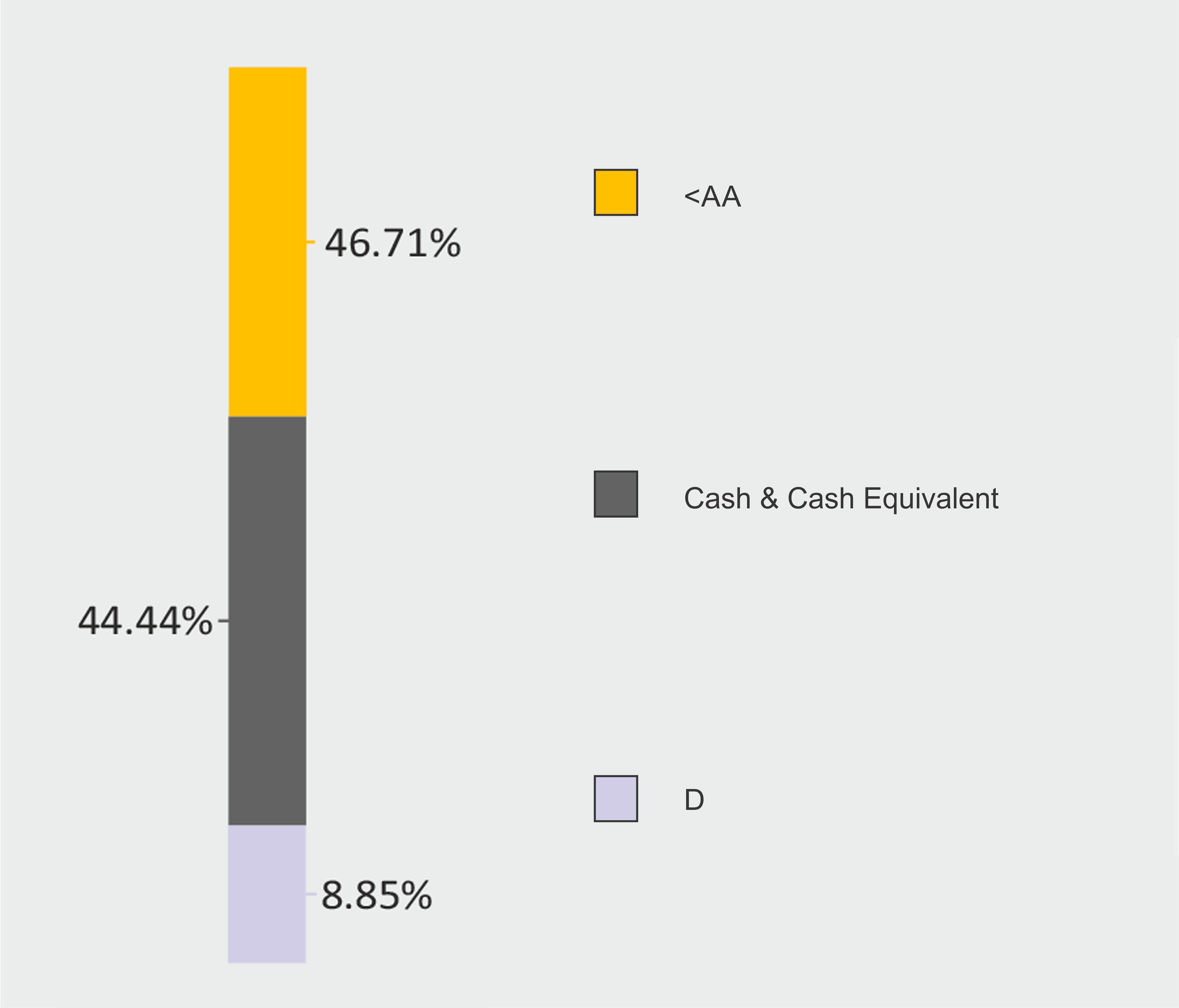

| Name of Instrument | Rating | % to Net Assets |

| DEBT INSTRUMENTS | ||

| BOND & NCD's | ||

| Listed / awaiting listing on the stock exchanges | ||

| Tata Motors Limited | CARE AA- | 0.16 |

| Bharti Airtel Limited | CRISIL AA | 0.06 |

| Total | 0.22 | |

| Unlisted | ||

| Nayara Energy Limited | CARE AA | 46.49 |

| Sintex-BAPL Limited@ | BWR D | 8.84 |

| Total | 55.33 | |

| MONEY MARKET INSTRUMENTS | ||

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 32.86 | |

| Total | 32.86 | |

| Cash & Cash Equivalent | ||

| Net Receivables/Payables | 11.59 | |

| Total | 11.59 | |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

DSP Credit Risk Fund erstwhile known as DSP Income Opportunities FundNotes:1.. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND, & BWR.

2. @security is below investment grade or default

3. In case of below securities, DSP Mutual Fund has ignored prices provided by valuation agencies.

Disclosure vide circular no. SEBI/HO/IMD/DF4/CIR/P/2019/41 dated March 22, 2019 & SEBI/HO/IMD/ DF4/CIR/P/2019/102 dated September 24,2019 for detailed rationale along with other details are available at the below mentioned links

| Security | ISIN | Value of the security considered under net receivables (i.e. value recognized in NAV in absolute terms and as % to NAV) (Rs.in lakhs) | Total amount (including principal and interest) that is due to the scheme on that investment (Rs.in lakhs) | |

| 0% IL&Fs Transportation Networks Limited Ncd Series A 23032019 | INE975G08140 | 0.00 | 0.00% | 23,396.18 |

| 0% IL&Fs Energy Development Company Limited Ncd 07062019 | INE938L08049 | 0.00 | 0.00% | 13,861.96 |

| 0% IL&FS Energy Development Company Limited Ncd 28062019 | INE938L08056 | 0.00 | 0.00% | 10,645.02 |

| 6% Coffee Day Natural Resources Pvt Ltd Ncd 23122019 (P/C 24122017, Call 31102018 & 23062019) | INE634N07075 | 3,787.45 | 11.56% | 7,881.79 |

| Performance (CAGR Returns in %) | ||||

| 1 yr | 3 yr | 5 yr | SI* | |

| 5.62 | 1.99 | 4.82 | 6.44 | |

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns are for Regular Plan - Growth Option Click here for performance in SEBI prescribed format.

An Open ended income Scheme,

seeking to generate returns

commensurate with risk from a

portfolio constituted of money

market securities and/or debt

securities.

There is no assurance that the

investment objective of the

Scheme will be realized.

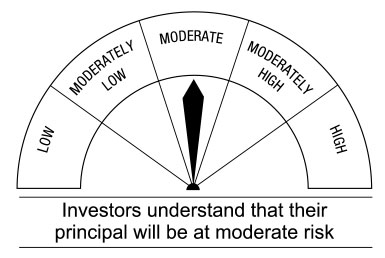

This Scheme is suitable for investors who are seeking*

• Income over a medium-term to long term investment horizon

• Investment predominantly in corporate bonds which are AA and below rated instruments

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.