|

DSP Arbitrage Fund An open ended scheme investing in arbitrage opportunities |

|

|

M. Suryanarayanan (Equity Portion)

Total work experience of 11

years.

Managing this Scheme since

September, 2018

Kedar Karnik

Total work experience of 14

years.

Managing this Scheme since

June 2020.

January 25, 2018

NIFTY 50 Arbitrage Index

| Regular Plan | |

| Growth: | ₹ 11.583 |

| Direct Plan | |

| Growth: | ₹ 11.773 |

₹ 995 Cr

₹ 1,010 Cr

12.26

| Regular Plan : | 0.93% |

| Direct Plan : | 0.37% |

0.16 years

0.15 years

4.87%

0.16 years

2 Yr 8 Mn

• If the units redeemed or switched-out are

upto 10% of the units (the limit) purchased

or switched within 30 days from the date of

allotment: Nil;

• If units redeemed or switched out are in

excess of the limit within 30 days from the

date of allotment: 0.25%;

• If units are redeemed or switched out on or

after 30 days from the date of allotment: Nil.

Data As On September 30, 2020

| Name of Instrument | % to Net Assets | |

| EQUITY & EQUITY RELATED | ||

| Listed / awaiting listing on the stock exchanges | ||

| Banks | 17.45 | |

| ✔ ICICI Bank Limited | 7.28 | |

| ✔ IndusInd Bank Limited | 6.99 | |

| Axis Bank Limited | 1.78 | |

| The Federal Bank Limited | 1.13 | |

| Bandhan Bank Limited | 0.28 | |

| Petroleum Products | 8.45 | |

| ✔ Reliance Industries Limited | 7.29 | |

| Bharat Petroleum Corporation Limited | 0.77 | |

| Hindustan Petroleum Corporation Limited | 0.38 | |

| Indian Oil Corporation Limited | * | |

| Telecom - Services | 7.88 | |

| ✔ Bharti Airtel Limited | 7.79 | |

| Vodafone Idea Limited | 0.09 | |

| Finance | 7.32 | |

| ✔ Housing Development Finance Corporation Limited | 4.89 | |

| Piramal Enterprises Limited | 0.58 | |

| Manappuram Finance Limited | 0.50 | |

| Max Financial Services Limited | 0.44 | |

| Mahindra & Mahindra Financial Services Limited | 0.35 | |

| SBI Life Insurance Company Limited | 0.21 | |

| Muthoot Finance Limited | 0.15 | |

| REC Limited | 0.11 | |

| HDFC Life Insurance Company Limited | 0.04 | |

| L&T Finance Holdings Limited | 0.03 | |

| ICICI Prudential Life Insurance Company Limited | * | |

| Non - Ferrous Metals | 4.26 | |

| ✔ Vedanta Limited | 4.16 | |

| National Aluminium Company Limited | 0.10 | |

| Pharmaceuticals | 4.23 | |

| ✔ Aurobindo Pharma Limited | 4.16 | |

| Dr. Reddy's Laboratories Limited | 0.05 | |

| Sun Pharmaceutical Industries Limited | 0.01 | |

| Cement | 3.01 | |

| Grasim Industries Limited | 1.94 | |

| Ambuja Cements Limited | 1.01 | |

| The Ramco Cements Limited | 0.06 | |

| Ferrous Metals | 2.41 | |

| Jindal Steel & Power Limited | 2.25 | |

| Steel Authority of India Limited | 0.12 | |

| JSW Steel Limited | 0.03 | |

| Trading | 2.32 | |

| ✔ Adani Enterprises Limited | 2.32 | |

| Auto Ancillaries | 1.34 | |

| Balkrishna Industries Limited | 1.29 | |

| MRF Limited | 0.03 | |

| Exide Industries Limited | 0.01 | |

| Auto | 1.26 | |

| Bajaj Auto Limited | 0.62 | |

| Tata Motors Limited | 0.49 | |

| Ashok Leyland Limited | 0.15 | |

| Pesticides | 1.05 | |

| UPL Limited | 1.05 | |

| Consumer Non Durables | 0.97 | |

| United Spirits Limited | 0.38 | |

| Colgate Palmolive (India) Limited | 0.32 | |

| ITC Limited | 0.19 | |

| Godrej Consumer Products Limited | 0.07 | |

| Transportation | 0.82 | |

| Adani Ports and Special Economic Zone Limited | 0.82 | |

| Media & Entertainment | 0.76 | |

| Zee Entertainment Enterprises Limited | 0.56 | |

| Sun TV Network Limited | 0.20 | |

| Software | 0.75 | |

| Coforge Limited | 0.51 | |

| Wipro Limited | 0.24 | |

| Industrial Products | 0.41 | |

| Bharat Forge Limited | 0.41 | |

| Industrial Capital Goods | 0.35 | |

| Bharat Heavy Electricals Limited | 0.35 | |

| Minerals/Mining | 0.22 | |

| NMDC Limited | 0.22 | |

| Oil | 0.20 | |

| Oil & Natural Gas Corporation Limited | 0.20 | |

| Construction Project | 0.06 | |

| GMR Infrastructure Limited | 0.04 | |

| Larsen & Toubro Limited | 0.01 | |

| Construction | 0.02 | |

| DLF Limited | 0.02 | |

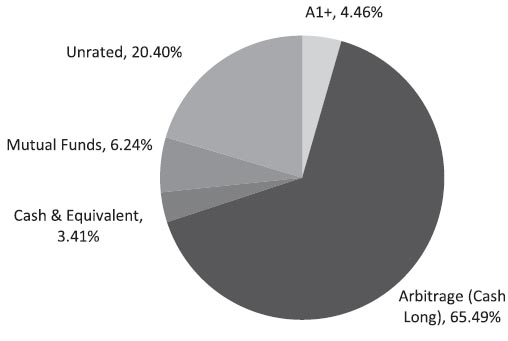

| Total 65.49% | ||

| Name of Instrument | % to Net Assets | |

| MONEY MARKET INSTRUMENTS | ||

| Certificate of Deposit | ||

| ✔ National Bank for Agriculture and Rural Development | IND A1+ | 2.98 |

| Total | 2.98 | |

| Commercial Papers | ||

| Listed / awaiting listing on the stock exchanges | ||

| National Bank for Agriculture and Rural Development | IND A1+ | 1.48 |

| Total | 1.48 | |

| TREPS / Reverse Repo Investments / Corporate Debt Repo | 3.52 | |

| Total | 3.52 | |

| Mutual Funds | ||

| ✔ DSP Liquidity Fund - Direct - Growth | 6.24 | |

| Total | 6.24 | |

| Fixed Deposit | ||

| Punjab National Bank 01 Oct 2020 (Duration - 366 Days) | Unrated | 1.61 |

| Punjab National Bank 31 Oct 2020 (Duration - 366 Days) | Unrated | 1.49 |

| Punjab National Bank 25 Oct 2020 (Duration - 366 Days) | Unrated | 1.06 |

| Bank of Baroda 05 Oct 2020 (Duration - 96 Days) | Unrated | 1.01 |

| Bank of Baroda 07 Oct 2020 (Duration - 96 Days) | Unrated | 1.01 |

| Punjab National Bank 24 Oct 2020 (Duration - 366 Days) | Unrated | 0.85 |

| HDFC Bank Limited 12 Oct 2020 (Duration - 186 Days) | Unrated | 0.54 |

| ICICI Bank Limited 09 Nov 2020 (Duration - 367 Days) | Unrated | 0.53 |

| ICICI Bank Limited 11 Nov 2020 (Duration - 366 Days) | Unrated | 0.53 |

| Axis Bank Limited 07 Oct 2020 (Duration - 391 Days) | Unrated | 0.53 |

| Axis Bank Limited 08 Oct 2020 (Duration - 391 Days) | Unrated | 0.53 |

| ICICI Bank Limited 13 Nov 2020 (Duration - 366 Days) | Unrated | 0.21 |

| ICICI Bank Limited 07 Dec 2020 (Duration - 367 Days) | Unrated | 0.21 |

| Bank of Baroda 07 Dec 2020 (Duration - 367 Days) | Unrated | 0.21 |

| ICICI Bank Limited 05 Jan 2021 (Duration - 393 Days) | Unrated | 0.21 |

| ICICI Bank Limited 06 Jan 2021 (Duration - 393 Days) | Unrated | 0.21 |

| ICICI Bank Limited 06 Jan 2021 (Duration - 392 Days) | Unrated | 0.21 |

| ICICI Bank Limited 07 Jan 2021 (Duration - 392 Days) | Unrated | 0.21 |

| ICICI Bank Limited 11 Jan 2021 (Duration - 395 Days) | Unrated | 0.21 |

| ICICI Bank Limited 14 Jan 2021 (Duration - 395 Days) | Unrated | 0.21 |

| ICICI Bank Limited 15 Jan 2021 (Duration - 395 Days) | Unrated | 0.21 |

| ICICI Bank Limited 13 Jan 2021 (Duration - 392 Days) | Unrated | 0.21 |

| ICICI Bank Limited 18 Jan 2021 (Duration - 396 Days) | Unrated | 0.21 |

| ICICI Bank Limited 19 Jan 2021 (Duration - 396 Days) | Unrated | 0.21 |

| ICICI Bank Limited 20 Jan 2021 (Duration - 393 Days) | Unrated | 0.21 |

| ICICI Bank Limited 05 Feb 2021 (Duration - 393 Days) | Unrated | 0.21 |

| ICICI Bank Limited 08 Feb 2021 (Duration - 395 Days) | Unrated | 0.21 |

| ICICI Bank Limited 09 Feb 2021 (Duration - 393 Days) | Unrated | 0.21 |

| Punjab National Bank 15 Jan 2021 (Duration - 367 Days) | Unrated | 0.21 |

| Punjab National Bank 14 Jan 2021 (Duration - 366 Days) | Unrated | 0.21 |

| Punjab National Bank 20 Jan 2021 (Duration - 372 Days) | Unrated | 0.21 |

| ICICI Bank Limited 10 Feb 2021 (Duration - 393 Days) | Unrated | 0.21 |

| Punjab National Bank 19 Jan 2021 (Duration - 371 Days) | Unrated | 0.21 |

| Punjab National Bank 18 Jan 2021 (Duration - 370 Days) | Unrated | 0.21 |

| ICICI Bank Limited 11 Feb 2021 (Duration - 393 Days) | Unrated | 0.21 |

| ICICI Bank Limited 12 Feb 2021 (Duration - 393 Days) | Unrated | 0.21 |

| Punjab National Bank 19 Jan 2021 (Duration - 368 Days) | Unrated | 0.21 |

| Punjab National Bank 18 Jan 2021 (Duration - 367 Days) | Unrated | 0.21 |

| Bank of Baroda 25 Jan 2021 (Duration - 370 Days) | Unrated | 0.21 |

| Bank of Baroda 27 Jan 2021 (Duration - 372 Days) | Unrated | 0.21 |

| Bank of Baroda 21 Jan 2021 (Duration - 366 Days) | Unrated | 0.21 |

| Bank of Baroda 28 Jan 2021 (Duration - 373 Days) | Unrated | 0.21 |

| Bank of Baroda 22 Jan 2021 (Duration - 367 Days) | Unrated | 0.21 |

| Bank of Baroda 08 Feb 2021 (Duration - 383 Days) | Unrated | 0.21 |

| Bank of Baroda 05 Feb 2021 (Duration - 380 Days) | Unrated | 0.21 |

| Bank of Baroda 12 Feb 2021 (Duration - 386 Days) | Unrated | 0.21 |

| Bank of Baroda 15 Feb 2021 (Duration - 389 Days) | Unrated | 0.21 |

| Bank of Baroda 23 Feb 2021 (Duration - 396 Days) | Unrated | 0.21 |

| Bank of Baroda 22 Feb 2021 (Duration - 395 Days) | Unrated | 0.21 |

| Bank of Baroda 25 Feb 2021 (Duration - 395 Days) | Unrated | 0.21 |

| Bank of Baroda 26 Feb 2021 (Duration - 395 Days) | Unrated | 0.21 |

| Bank of Baroda 01 Mar 2021 (Duration - 391 Days) | Unrated | 0.21 |

| Bank of Baroda 03 Mar 2021 (Duration - 393 Days) | Unrated | 0.21 |

| Bank of Baroda 02 Mar 2021 (Duration - 392 Days) | Unrated | 0.21 |

| Bank of Baroda 04 Mar 2021 (Duration - 394 Days) | Unrated | 0.21 |

| Bank of Baroda 05 Mar 2021 (Duration - 395 Days) | Unrated | 0.21 |

| Bank of Baroda 09 Mar 2021 (Duration - 398 Days) | Unrated | 0.21 |

| Bank of Baroda 12 Mar 2021 (Duration - 401 Days) | Unrated | 0.21 |

| Bank of Baroda 15 Mar 2021 (Duration - 404 Days) | Unrated | 0.21 |

| Bank of Baroda 10 Mar 2021 (Duration - 399 Days) | Unrated | 0.21 |

| Bank of Baroda 16 Mar 2021 (Duration - 405 Days) | Unrated | 0.21 |

| Bank of Baroda 08 Mar 2021 (Duration - 397 Days) | Unrated | 0.21 |

| Total | 20.40 | |

| Cash & Cash Equivalent | ||

| Cash Margin | 2.55 | |

| Net Receivables/Payables | -2.66 | |

| Total | -0.11 | |

| GRAND TOTAL | 100.00 |

as on 30th Sept'20

✔ Top Ten Holdings

* Less than 0.01%

@@Computed on the invested amount for debt portfolio.

Notes : 1. All corporate ratings are assigned by rating agencies like CRISIL, CARE, ICRA, IND

| Growth of Rs. 1 L invested at inception: | 1.16 L |

| SIP Returns(In %) | ||||

| SI* | ||||

| 5.24 | ||||

| Outperformed Benchmark TRI (calendar year) | NIFTY 50 Arbitrage Index 31%* *Regular plan - growth is considered for DSP Equity Fund |

| 1 yr | |

| Minimum (%) | 4.4 |

| Maximum (%) | 6.9 |

| Average (%) | 6.0 |

| % times negative returns | – |

| % of times returns are in excess of 7% | – |

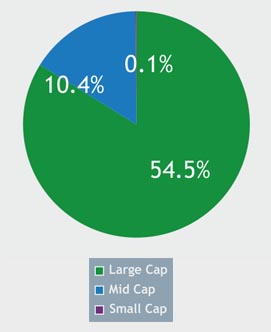

Mid Cap: 101st -250th company in terms of full market capitalization

Small Cap: 251st company onwards in terms of full market capitalization.

The investment objective of

the Scheme is to generate

income through arbitrage

opportunities between cash and

derivative market and arbitrage

opportunities within the

derivative market. Investments

may also be made in debt &

money market instruments.

There is no assurance that the

investment objective of the

Scheme will be realized.

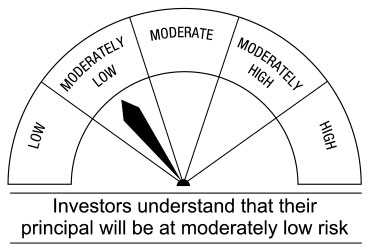

This open ended Scheme is suitable for investors who are seeking*

• Income over a short-term investment horizon

• Investment in arbitrage opportunities in the cash & derivatives segment of the equity market

* Investors should consult their financial advisors if in doubt whether the product is suitable for them.